Losing a husband is one of the most painful moments in a woman’s life. For widows of Ex-Servicemen (ESM), the emotional grief is often followed by a second challenge—paperwork, family pension formalities, welfare benefits, and administrative processes.

Many widows feel overwhelmed because they do not know where to start. Some families delay important steps, and later face avoidable problems like pension stoppage, claim rejection, or missing documents.

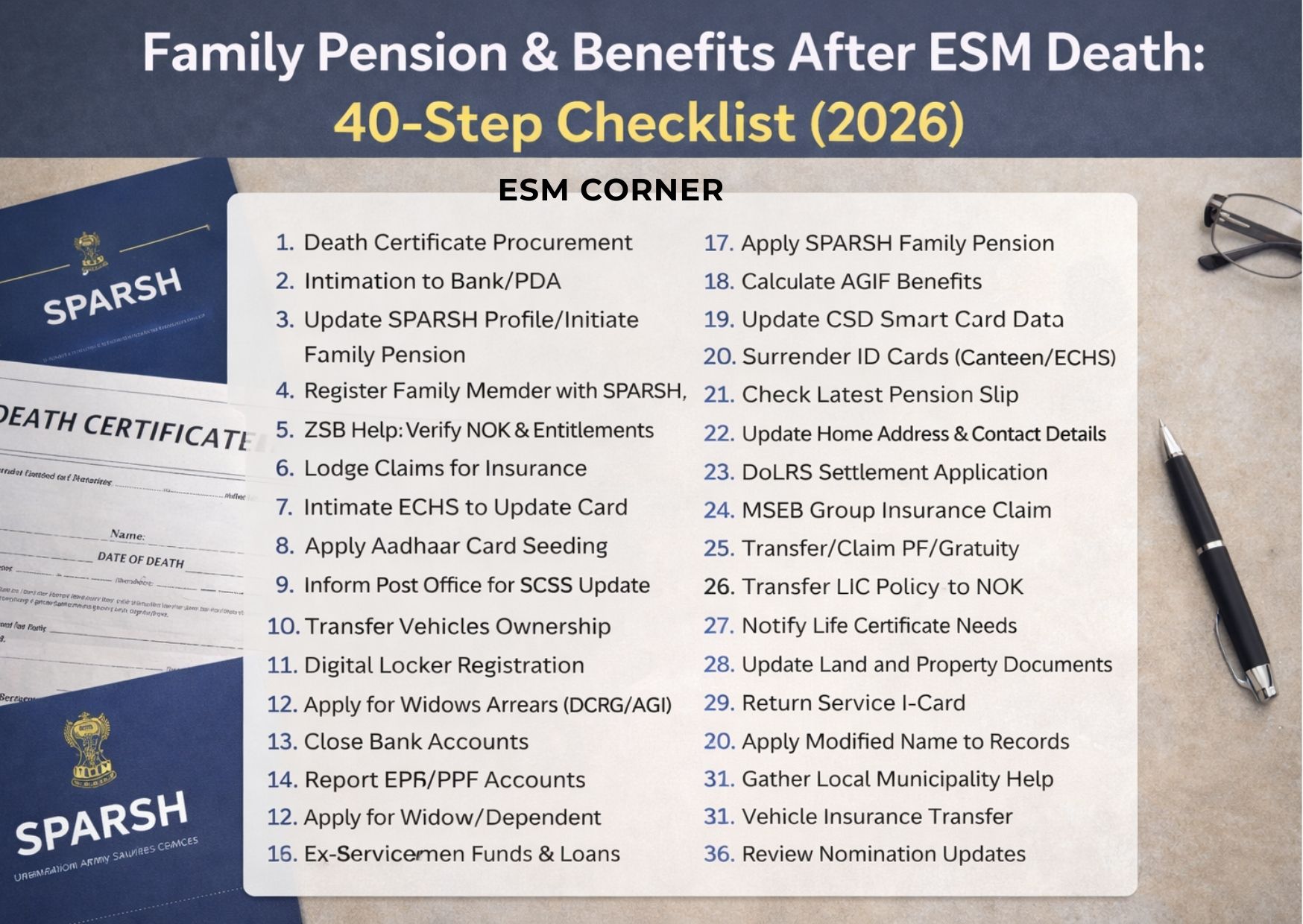

This guide is written to help you with clarity and confidence. It explains 40 essential steps that every ESM widow should follow after her husband’s demise, so that all lawful entitlements, benefits and financial security are protected.

A. Immediate Actions & Legal Documents (Step 1–6)

1) Collect the Medical Certificate

Obtain the medical certificate from the hospital or the authorised doctor clearly mentioning the cause of death. This becomes the first supporting document for all future claims.

2) In case of unnatural death, collect extra documents

If the death is accidental, suspicious, or unnatural, ensure you collect:

- FIR copy

- Postmortem report

- Police investigation/report

These documents are critical for insurance and compensation claims.

3) Organise funeral arrangements

Decide the funeral place/time and inform close relatives. Do not rush paperwork before cremation/burial—focus on dignified last rites first.

4) Inform local authorities (where needed)

If required (especially in unnatural deaths), cooperate with police procedures to avoid delays in official certificates.

5) Apply for the Death Certificate quickly

After the funeral, apply for the official Death Certificate through the municipality/registrar office as early as possible. This is the most important document for pension and welfare claims.

6) Take multiple certified copies

Collect 10–15 copies of the Death Certificate, because banks, pension offices, insurance agencies, and property offices all require it.

B. Pension & SPARSH Process (Step 7–12)

7) Intimate death on SPARSH / pension system

If the pension is handled through SPARSH, update/intimate the death on SPARSH and upload the Death Certificate.

8) Apply for Family Pension through SPARSH

If the widow’s name is already mentioned in the SPARSH PPO, then family pension usually becomes smoother. Use the available online service options to initiate family pension.

✍️ Also read: For SPARSH portal complete guide for defence pensioners (family pension included), read this article.

9) Track your request regularly

After submitting any pension service request, keep the Token ID / acknowledgement and regularly track the status. Do not assume it will happen automatically.

10) Inform the pension bank to stop service pension (if applicable)

If pension is still being paid through the bank (not on SPARSH), visit the pension-disbursing bank and submit death information to stop the ESM’s pension immediately.

11) Apply for family pension through bank route (if SPARSH is not applicable)

Some PPOs are still bank-routed. If so, submit:

- death certificate

- KYC documents

- bank forms

to start family pension.

✍️ Also read: For family pension explained with OFP/EOFP rules and examples, read this detailed guide.

12) If widow’s name is not in PPO

In non-joint PPO cases or missing spouse details, approach:

- Zila Sainik Board (ZSB)

- concerned Record Office

so the PPO details can be corrected and family pension can be issued properly.

C. ZSB, Identity Card & Defence Documentation (Step 13–16)

13) Register/Update at Zila Sainik Board

Visit ZSB and submit death intimation. ZSB is the key support system for widows to access most welfare schemes.

14) Apply for Widow Identity Card

Apply for widow ID card through ZSB procedure. This becomes useful for ECHS benefits, welfare grants, and future documentation.

15) Submit deceased ESM ID Card

Return the deceased ESM identity card wherever required (ZSB/unit). This also helps prevent misuse.

16) Send death intimation to Record Office

Through ZSB, ensure death intimation reaches the correct service Record Office for official closure and claim processing.

Click here to read how to update your ZSB and Address after Retirement

D. Welfare Grants, Insurance & Education Support (Step 17–23)

17) Apply for Funeral / Demise grant

Most services provide some support/grant. Apply through proper channels with ZSB guidance.

18) Claim service insurance (AGI/NGI/AFGIS etc.)

Depending on the service, submit insurance claim forms through authorised channels. Attach all supporting documents.

19) Air Force case: apply for IAFBA Family Assistance

If the deceased was Air Force, check eligibility and apply for support through IAFBA.

20) Apply for children education grants

Many welfare schemes support children education. Apply on time because some schemes have annual windows.

21) Apply for Prime Minister Scholarship Scheme (PMSS)

Widows/wards may apply for PMSS through KSB portal (as applicable). This is a major support scheme for education.

22) Apply Regimental welfare support

Army widows can apply for regimental fund grants wherever eligible.

23) Explore additional welfare funds

Some welfare funds exist under DESW / state welfare schemes for widows. ZSB can guide you.

E. ECHS, CSD & Defence Entitlement Transfers (Step 24–27)

24) Update/Block deceased ESM ECHS card

ECHS card should be updated/blocked due to demise. Submit card at ECHS station as required.

25) Continue medical entitlement as family pensioner

Widows generally remain eligible for ECHS benefits as dependents/family pensioners. Update details so treatment continues smoothly.

26) Apply for widow’s CSD entitlement

Apply for a new CSD card (if eligible) under widow entitlement. Submit documents and return old card where required.

27) Return defence cards if required

Return old ID/canteen cards where required by issuing authority.

F. Banking & Financial Settlement (Step 28–33)

28) Close/transfer single bank accounts

Single accounts in the ESM’s name should be closed and balances transferred to nominee/legal heir.

29) Update nominee in widow’s pension account

Once pension starts, submit nominee forms so the account remains protected for future.

30) Claim LIC and other policies

Collect all policies (LIC, term insurance, mediclaim etc.) and submit claims on priority.

31) Transfer or close FDs/RDs and other deposits

Bank deposits must be transferred to nominee/heirs with death certificate and KYC.

32) Transfer shares/mutual funds/demat

Submit claim/transmission request to brokers/registrars. Keep all documents safe.

33) Close pending loans/credit cards

Clear outstanding dues. Inform banks early to avoid penalties and fraud misuse.

G. Identity & Fraud Prevention (Step 34–37)

34) Income tax and pending returns

If any return is pending, file correctly. If large assets exist, take help of CA.

35) Legal heir / representative assessee handling

For tax or financial matters, widow may need to be treated as legal heir/representative. Keep documents organised.

36) Lock Aadhaar biometrics (optional but recommended)

To prevent misuse, widow can lock biometrics on UIDAI portal. This is a safety action.

37) Remove name from voter list

Submit death certificate to local election office to remove the deceased name from electoral roll.

H. Property, Vehicle & Legal Transfers (Step 38–40)

38) Transfer vehicle ownership

Visit (regional Transport Office) RTO to transfer the vehicle to widow/legal heir. Also surrender/close driving licence where required.

39) Property transfer / mutation

Apply for mutation of property records (state-wise process differs). Keep death certificate, legal heir certificate, and ID proof.

40) Firearm ownership transfer (if applicable)

If the deceased had a licensed weapon, immediately follow legal procedure under Arms rules. Do not keep the weapon without legal transfer.

✍️ Also read: To download PPO and Corrigendum PPO from SPARSH step-by-step, read this article.

Final Advice for Widows (Very Important)

You are not alone. It is okay to take support from:

- family members

- Zila Sainik Board

- Record Office

- veteran organisations

✅ Most importantly: do not sign any financial/property papers in emotional pressure. Take time, confirm, and then proceed.

Your husband served the nation with dignity. Now your responsibility is to protect your family’s rightful entitlements with the same dignity—step by step.

For more updates on all post retirement affairs Click here to join our WhatsApp Group

Q1: What is the first thing a widow should do after the death of an Ex-Serviceman?

A: The first priority is to obtain the medical certificate and then apply for the official death certificate as early as possible, because most pension and welfare claims require it.

Q2: How many copies of the death certificate should be kept?

A: It is best to keep 10–15 certified copies, as banks, SPARSH, insurance companies, and property offices may ask for separate copies.

Q3: How is family pension started for ESM widows?

A: If the pension is on SPARSH, the widow can intimate the death and initiate family pension online (if her name exists in PPO). If not, the pension bank/ZSB/Record Office route may apply.

Q4: What should be done if the widow’s name is not mentioned in the PPO?

A: She should approach the Zila Sainik Board (ZSB) and the concerned Record Office to get documents corrected and ensure family pension is issued properly.

Q5: Can ECHS medical facility continue after the death of the ESM?

A: Yes. Most widows are eligible to continue ECHS medical entitlement as family pensioners, but ECHS records must be updated and the deceased card must be blocked/cancelled.

Q6: What benefits can widows claim apart from family pension?

A: Widows may claim funeral/demise grant, service insurance (AGI/NGI/AFGIS), education grants, PM Scholarship Scheme (PMSS), regimental funds, and other welfare schemes.

Q7: What is the role of Zila Sainik Board (ZSB) in widow cases?

A: ZSB helps widows with registration, widow ID cards, welfare schemes, record office intimation, and claim assistance. It is an important support system for ESM families.

Q8: Should bank accounts and FDs in the deceased soldier’s name be closed immediately?

A: Yes. Single accounts, FDs, RDs and other investments should be transferred/closed through nominee or legal heir process to avoid misuse and future complications.

Q9: Is Aadhaar biometric lock necessary after death?

A: It is not compulsory, but it is a recommended safety step to prevent misuse of Aadhaar authentication in case of fraud attempts.

Q10: What should a widow do about property and vehicle transfer?

A: She should apply for vehicle ownership transfer at RTO and property mutation/transfer as per state rules, using death certificate and legal heir documents.