Indian Armed Forces personnel retire much earlier than most civilian employees so that the services remain young, physically fit, and operationally effective. After retirement, many Ex-Servicemen (ESM) begin a second career in:

- Central and State Government Departments

- Public Sector Undertakings (PSUs)

- Public Sector Banks (PSBs)

- Insurance PSUs and government-linked institutions

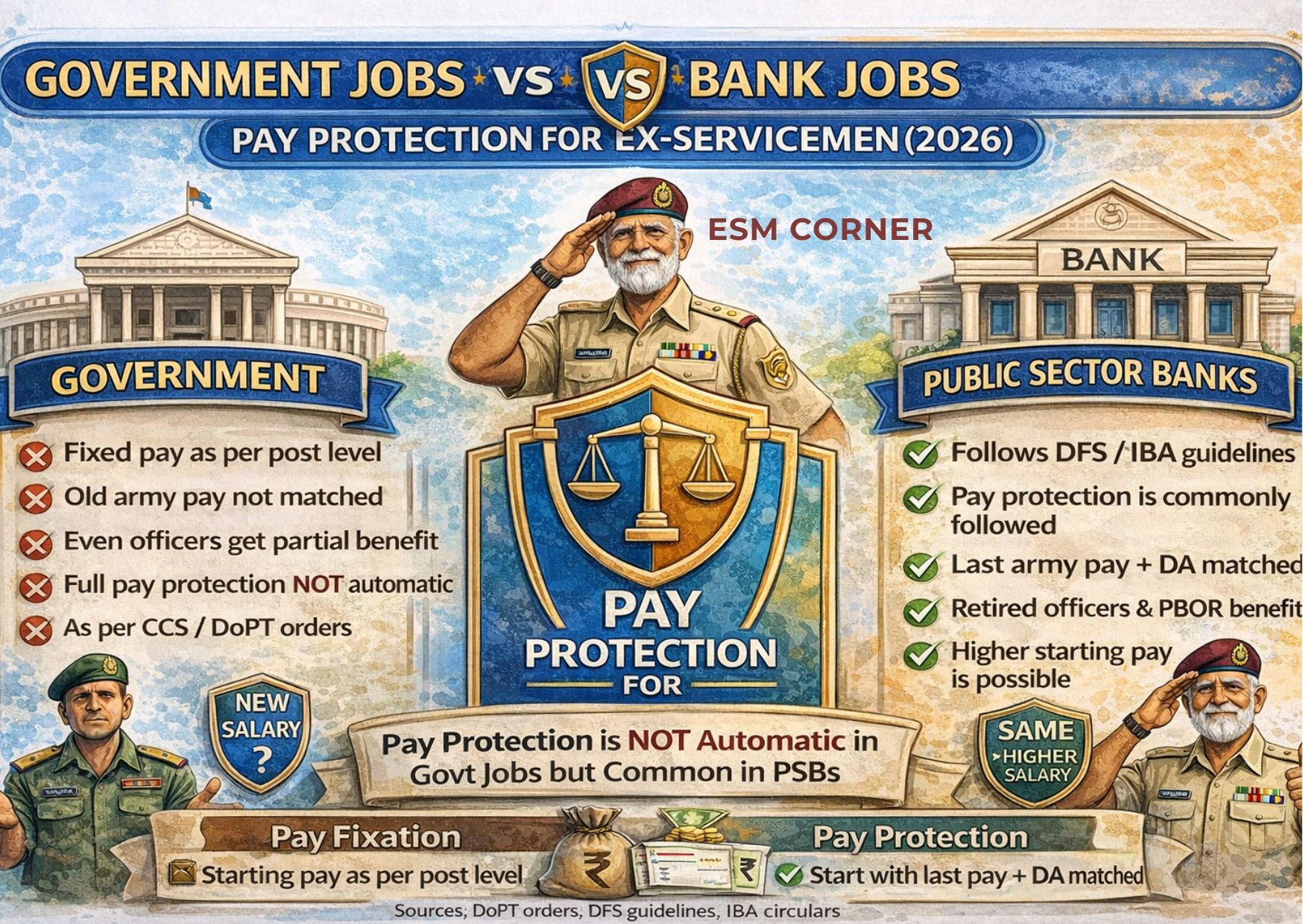

For most veterans, the first big question after joining a new job is about pay fixation and pay protection. In simple terms, veterans want to know whether their new salary will be fixed as per the civil post rules or whether their last drawn Army pay will be protected.

However, the biggest confusion starts when an ESM joins a civil post:

- How will pay fixation be done after joining a new job?

- Will pay protection apply so that the last drawn Army pay is not reduced?

- Why do banks often offer better salary outcomes than government departments, mainly due to stronger pay protection policies?

This article explains the difference between pay fixation and pay protection, along with the practical reality that ex-servicemen face in 2026.

1) What is Pay Fixation?

Pay fixation means deciding the starting basic pay of an Ex-Serviceman when he joins a civil job after retirement.

In most Central Government re-employment cases, pay fixation is guided by:

- CCS (Central Civil Services), (Fixation of Pay of Re-employed Pensioners) Orders, 1986

- Clarifications and Office Memorandum issued by DoPT from time to time

In simple terms:

Your new salary is determined mainly by the post you join, not by the pay you retired with in the Armed Forces.

This is the reason why many veterans feel that their civil pay looks “lower than expected”—because it is fixed as per rules, not sentiment.

2) What is Pay Protection?

Pay protection means fixing pay in such a way that your new salary does not fall below your last drawn pay (or last pay plus DA), as permitted by the organisation’s rules.

Important reality:

Pay protection is not a universal right in all government jobs. It is applicable only if the recruiting organisation has rules or policy provisions allowing it.

In short, pay protection is policy-based, not automatically guaranteed.

3) Pay Fixation in Central Government Jobs (Reality Check)

In normal Central Government re-employment:

- Pay is usually fixed at the minimum of the pay level of the post joined

- Past Army pay is not automatically matched

- Pension adjustment is done as per applicable rules (wherever required)

So even if a veteran retired at a high pay level, the new salary will generally start according to the pay level of the new recruitment post.

This feels unfair to many ex-servicemen, but legally it is considered rule-based pay fixation.

4) Pay Fixation for PBOR (JCOs/NCOs/OR) – The Most Common Case

For PBOR categories (JCOs/NCOs/Other Ranks), the common practice in most government departments is:

- Pay starts at the minimum pay of the post joined

- Full pay protection of last Army pay is generally not granted

Illustration

A Havildar retires with:

- Basic Pay: ₹40,000

- DA: ₹20,000

- Total last drawn: ₹60,000

He joins a Government job in Level-4:

- Pay normally starts at the Level-4 minimum (or near it as per rules)

Result: His last Army pay is not automatically protected.

5) Pay Fixation for Officers – Is there any special benefit?

Officers may sometimes receive limited relief depending on rules related to pension adjustment or ignorable pension provisions. However, the core principle remains the same:

- Pay generally starts at the minimum of the new post’s pay level

- Pension is adjusted as per applicable orders

- Full matching of last drawn Army pay is not guaranteed

There have also been revisions in the ignorable portion of pension for fixation purposes (as per DoPT policy updates), but this still does not mean full pay protection is ensured.

6) Where Pay Protection is Usually Not Available

Full pay protection is generally not available in:

- Central Government ministries and departments (routine re-employment)

- Many State Government departments

- Departments where no specific pay protection policy exists

A consistent legal position has been that pay in the new job depends on:

- the post

- the pay scale/pay level

- the applicable recruitment and fixation rules

and not on the last drawn military pay.

7) Why Banks Often Pay Better to Ex-Servicemen

This is where many veterans find better outcomes.

Public Sector Banks work under Ministry of Finance / Department of Financial Services (DFS) guidelines and banking industry instructions (including IBA-based procedures).

Banks commonly provide pay protection for eligible ESM, meaning:

- last drawn pay and DA are considered

- fixation is done to protect pay within bank pay scales and rules

This single difference becomes the reason why bank jobs feel more financially stable for retired defence personnel.

8) Bank Pay Protection Example (Why PSBs are Better)

An ESM retires with:

- Basic pay: ₹40,000

- DA: ₹20,000

- Total last drawn: ₹60,000

He joins a Public Sector Bank:

- the bank attempts to protect pay (as per internal rules and scale limits)

Result: starting pay is often fixed close to ₹60,000 or even higher, depending on scale and allowances.

9) Organisations Where Pay Protection is Commonly Seen

Public Sector Banks (Common Examples)

- SBI

- PNB

- Bank of Baroda

- Canara Bank

- Union Bank of India

- Bank of India

- Central Bank of India

- Indian Bank

- UCO Bank

- Punjab & Sind Bank

Insurance PSUs (subject to internal rules)

- LIC of India

- New India Assurance

- United India Insurance

- Oriental Insurance

- National Insurance

Implementation can still vary due to audit interpretations, HR circulars, and internal administrative practice.

10) Common Problems Faced by Ex-Servicemen

(1) Confusion between Fixation and Protection

Many veterans assume pay protection applies everywhere.

In reality, it is not automatic.

(2) Audit objections and recovery cases

Sometimes higher pay is granted initially, but later audits object and issue reduction or recovery instructions. This has led to disputes and litigation in multiple cases.

(3) Lack of documentation

Many pay issues happen because veterans do not submit complete documents such as:

- PPO copy

- Last Pay Certificate (LPC) / pay details

- DA rate proof at retirement

- discharge/release documents

11) Practical Advice for Veterans (Must Follow)

- Read the recruitment notification carefully

If pay protection is mentioned, it is a major financial advantage. - Prefer PSBs/Insurance/PSUs if pay is your priority

They usually offer smoother pay transition for veterans. - Keep documents ready

- PPO

- LPC / last pay details

- DA proof

- Discharge book / release order

- Demand written pay fixation calculation

Always ask for the fixation calculation sheet formally. - Challenge wrong fixation properly

If the fixation violates written rules, follow the route:

Representation → Grievance → Legal remedy (CAT/High Court if required)

Conclusion

Pay fixation and pay protection are not the same.

- In most Government departments, pay is fixed as per the post’s pay level and full pay protection is generally not available.

- In Public Sector Banks (and some Insurance PSUs), pay protection is widely practiced under DFS/IBA-based guidelines.

For any ESM planning a second career in 2026, understanding this difference is crucial. A veteran who knows the rules is far less likely to suffer financial loss later.

Q1. What is pay fixation for Ex-Servicemen in government jobs?

A1. Pay fixation means deciding the starting basic pay of an Ex-Serviceman when he joins a civil job after retirement. In most government jobs, pay starts as per the pay level of the post joined, not as per last Army pay.

Q2. What is pay protection and is it a legal right for all ESM?

A2. Pay protection means ensuring that the new salary is not lower than the last drawn pay (or last pay + DA). It is not a general legal right in all government jobs—it depends on the employer’s policy and rules.

Q3. Do PBOR (JCOs/NCOs/OR) get pay protection in government re-employment?

A3. In most normal Central/State Government re-employment cases, PBOR do not get full pay protection. Pay is usually fixed at the minimum of the pay level of the post joined as per CCS/DoPT rules.

Q4. Do retired officers get any special benefit in pay fixation?

A4. Officers may get limited benefit due to pension adjustment rules (like ignorable portion of pension), depending on the category. However, full matching of last military pay is generally not guaranteed even for officers.

Q5. Why do Public Sector Banks (PSBs) often give better salary to ESM?

A5. PSBs follow Ministry of Finance/DFS and banking guidelines, where pay protection for eligible ESM is commonly provided. This is why bank re-employment often results in better pay compared to government departments.

Q6. In which organisations pay protection is commonly available for ESM?

A6. Pay protection is commonly seen in Public Sector Banks and in many Insurance PSUs, subject to their internal circulars and pay rules. Implementation may vary across banks and audit observations.

Q7. What documents are required for correct pay fixation/pay protection?

A7. Veterans should keep ready: PPO, discharge/release order, Last Pay Certificate (LPC) or last pay details, and DA rate at retirement. Missing documents are one of the biggest reasons for wrong fixation.

Q8. What should an ESM do if pay protection is wrongly denied or reduced later?

A8. First, submit a written representation to HR/branch with policy references. If still not resolved, use grievance channels and legal remedy (CAT/High Court) where applicable—especially if the fixation violates official guidelines.

👉 ALSO READ I 10 MUST-KNOW BENEFITS AND UPDATES FROM THE DIRECTORATE OF CANTEEN SERVICES IN 2026