A soldier’s life teaches discipline.

We learn to wake up on time.

We learn to keep our uniform perfect.

We learn to stand strong in difficult situations.

We learn to keep our word.

But after some years—whether you are still serving or already retired—life starts testing you in a different way.

Not in the field.

Not in training.

Not in operations.

It tests you silently… through money decisions.

Children’s education.

Medical emergency.

Home purchase.

Daughter’s marriage.

A sudden repair expense.

A loan for family stability.

And when a Defence person goes to a bank with full confidence, many times they hear a sentence that feels painful:

“Sir, your CIBIL score is low.”

That moment hurts.

Because a soldier doesn’t expect the system to doubt him.

A veteran doesn’t expect rejection after years of service.

But here is the honest truth:

✅ Bank doesn’t judge your medals.

✅ Bank doesn’t judge your sacrifice.

✅ Bank judges your credit behaviour.

And the proof of that behaviour is your CIBIL Score.

This article is written to help you understand one thing clearly:

A strong CIBIL score is the silent power behind low-interest loans, fast approval, and financial peace.

1) What is a CIBIL Score? (Simple Meaning)

CIBIL score is a 3-digit number from 300 to 900.

It tells banks:

- Do you pay EMI on time?

- Do you clear credit card bills properly?

- Are you over-borrowing?

- Are you a safe customer?

Think of it like your financial ACR (report card).

📌 Higher score = more trust

📌 More trust = lower interest (ROI)

📌 Lower interest = less burden on your family

2) Why CIBIL Score Matters for Defence People (More Than Others)

Many Defence personnel believe:

“We are in Defence Salary Package / Pension account… we will get loan easily.”

Yes—Defence schemes help.

But please remember:

✅ Defence scheme helps only when your credit profile supports it.

Because bank decisions today are mostly system-based.

Even if you are serving, salary is credited regularly, and your file looks clean—

a low credit score can still make the bank charge you higher ROI or even reject.

So the real reality is:

Uniform gives respect in society.

CIBIL score decides respect in banking.

3) What CIBIL Score Should Defence Personnel Maintain?

Here is the practical range:

- 800–900 → Excellent (premium borrower)

- 750–799 → Very Good (best for low ROI)

- 700–749 → Good (loan possible, normal ROI)

- 650–699 → Average (conditions may apply)

- Below 650 → Risk zone (reject / high ROI)

🎯 Target for Defence families:

✅ Maintain 750+ minimum

⭐ Best benefits in 780+ zone

4) Biggest Benefit: Low Interest Rate (ROI)

Many people ignore interest rate difference and say:

“1% difference only.”

But 1% difference on a 5–7 year loan is NOT small.

It becomes:

✅ higher EMI

✅ more interest paid overall

✅ more stress at home

✅ delayed financial freedom

So yes:

CIBIL score is not a number. It is money saving.

A strong score means the bank sees you as low-risk, so it offers you a better deal.

5) What Other Benefits You Get with High CIBIL Score

A good score gives you:

✅ faster approval

✅ higher loan eligibility

✅ better credit card limit

✅ top-up loans easier

✅ pre-approved offers

✅ less paperwork sometimes

✅ better negotiation power

In simple words:

Good CIBIL = bank works with you, not against you.

SUBJECTIVE REALITY: Why Defence People Often Face CIBIL Problems

Let me speak from the heart.

Defence personnel are disciplined—but not everyone is trained in financial systems.

A soldier posted in field area is not thinking about:

- credit utilization rule

- EMI auto-debit date

- minimum due trap

- multiple loan inquiries

He is thinking about duty, survival, and family.

Similarly, many veterans after retirement face a different battle:

No unit routine.

No structured schedule.

No briefing.

No system guiding daily life.

So financial decisions become emotional.

And a few small mistakes—only small mistakes—slowly damage the CIBIL score.

Then one day a veteran feels:

“Maine desh ke liye 20 saal diye…

aur bank mujhe risky customer samajh raha hai.”

That feeling is painful.

But remember one thing:

✅ Your CIBIL score is NOT your character certificate.

✅ It is only your credit discipline report.

And discipline can be rebuilt.

6) Top Reasons Defence Personnel Lose CIBIL Score (Common Mistakes)

1) EMI Bounce (ECS/Auto debit failure)

This is the biggest enemy.

Reasons:

- low balance in account

- salary/pension credited late

- forgot auto-debit date

- travelling / posting distractions

Even 1 EMI bounce damages score badly.

Defence rule: Keep 2 EMI buffer always.

2) Paying Only “Minimum Due” on Credit Card

This is slow poison.

Minimum due means:

- full bill not paid

- interest starts accumulating

- outstanding never becomes zero

- score drops slowly

Rule: Always pay full credit card bill.

3) High Credit Card Usage (Utilization)

If you use 70–90% of credit limit regularly, bank thinks you are stressed.

Rule: Keep usage below 30%.

Example:

Limit ₹1,00,000 → spend below ₹30,000 (best practice)

4) Too Many Small Loans

Mobile EMI + consumer loan + credit card EMI + personal loan = danger.

Bank system reads this as:

loan-dependent lifestyle

Rule: Avoid unnecessary small loans.

5) Too Many Loan Inquiries

Applying in multiple banks reduces score.

Rule: Apply only to 1–2 banks after comparing options.

7) The Golden Soldier Rule: Never Miss EMI

In the military, you don’t miss parade.

In financial life:

✅ Never miss EMI.

Late payment affects your credit report for months.

3 Defence habits that save you:

- auto-debit on

- EMI buffer maintained

- emergency fund ready

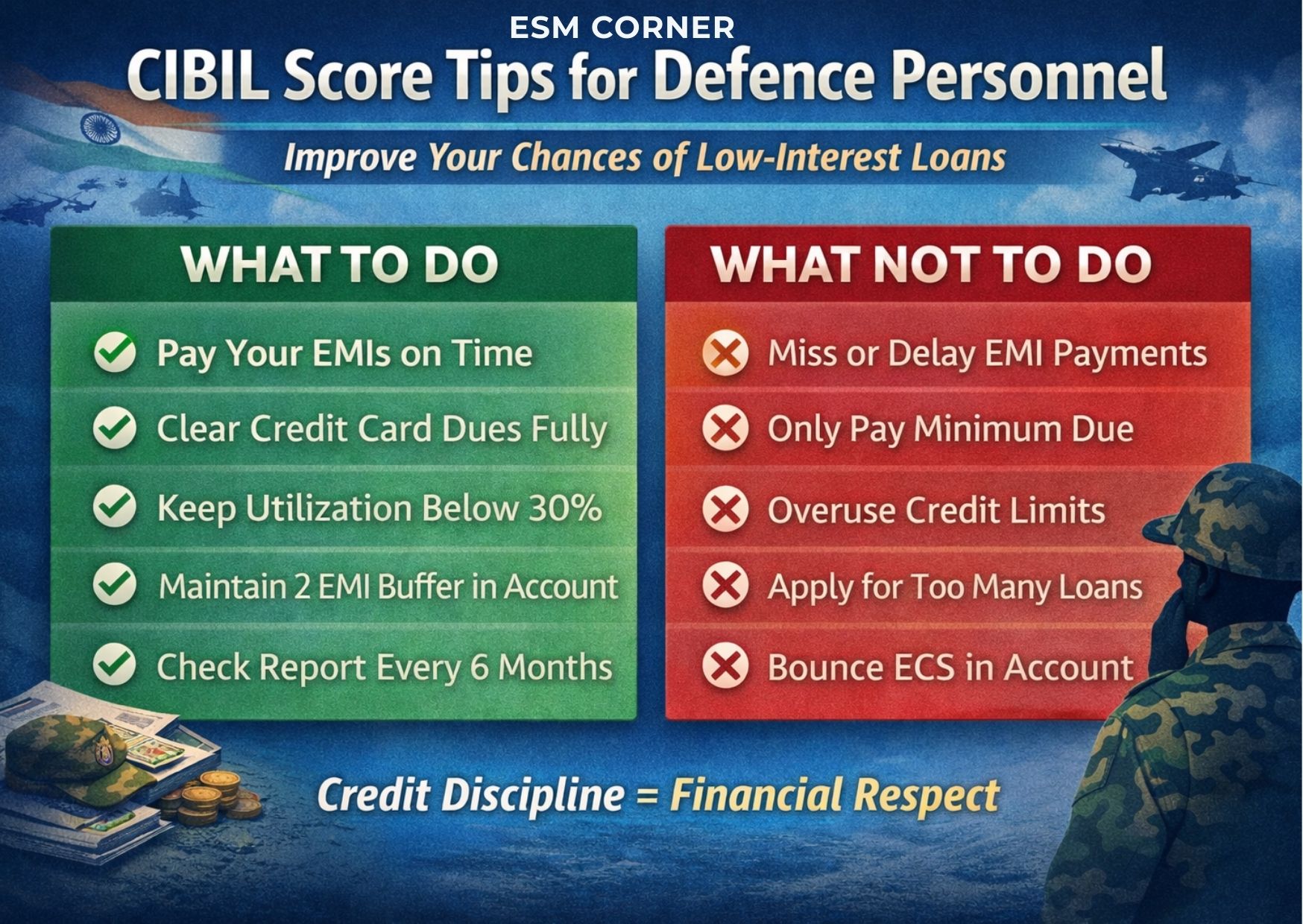

8) How to Maintain 750+ CIBIL Score (Defence Checklist)

Follow this simple checklist:

✅ pay all EMIs on time

✅ avoid EMI bounce

✅ credit card full payment (no minimum due)

✅ utilization under 30%

✅ avoid too many loans together

✅ avoid too many loan enquiries

✅ keep one stable salary/pension account

✅ don’t close oldest credit card (history matters)

✅ check credit report every 6 months

✅ close loans properly + keep NOC

9) FOIR Rule: Don’t Overload Your Salary/Pension

Banks also check FOIR:

How much of your income is already going into EMI?

If salary/pension = ₹40,000

and total EMI = ₹25,000

then bank feels risk.

✅ Best rule for Defence families:

Keep EMI burden within 35%–40% of income

👉 Click here to explore the Armed Forces Tribunal and learn how it provides speedy justice for serving and retired personnel.

10) How to Negotiate Low ROI Loan (Serving + Veterans)

If your score is good (750+/780+), negotiate confidently.

Say:

- “My credit score is above 780.”

- “My salary/pension credits are regular.”

- “No defaults, no EMI bounce.”

Ask for:

✅ lowest ROI under Defence scheme

✅ processing fees discount/waiver

✅ avoid unnecessary add-ons

11) If Your Score is Low—Can It Improve?

Yes. 100%.

CIBIL recovery is like fitness:

Consistency + patience.

✅ Recovery Timeline

- 3 months: improvement starts

- 6 months: strong improvement

- 12 months: excellent recovery possible

✅ What to do

- avoid new loan applications for some time

- clear pending dues

- pay EMIs strictly on time

- reduce credit card usage

- dispute wrong entries in report

Conclusion: CIBIL Score is Your Financial Uniform

Uniform gives identity.

CIBIL score gives financial credibility.

And the best part?

You can control it.

Maintain:

🎯 750+ minimum

⭐ 780+ best

Because in today’s world:

✅ A strong CIBIL score is not luxury.

✅ It is protection for your family.

✅ It is the reason you get low-interest loans and financial peace.

Q1: What is the full form of CIBIL?

A: CIBIL stands for Credit Information Bureau (India) Limited.

Q2: What is a CIBIL score?

A: A CIBIL score is a 3-digit credit score (300 to 900) that shows your repayment discipline and credit history.

Q3: What is a good CIBIL score for Defence personnel and veterans?

A: 750+ is good, and 780+ is excellent for getting loans at lower interest rates.

Q4: Does checking my CIBIL score reduce it?

A: No. Self-checking your score (soft enquiry) does not reduce your CIBIL score.

Q5: How does EMI bounce or late payment affect CIBIL score?

A: EMI bounce/late payment can reduce your score significantly and may lead to higher ROI or loan rejection.

Q6: What should be the ideal credit card utilisation to maintain a good score?

A: It is best to keep credit card utilisation below 30% of your total limit.

Q7: How long does it take to improve a low CIBIL score?

A: Usually, improvement starts in 3–6 months, and strong recovery may take 6–12 months, depending on credit behaviour.

Q8: Can Defence pensioners get a loan with a low CIBIL score?

A: Yes, but the loan may come with higher interest rates, lower eligibility, or extra conditions.