Serving in the armed forces comes with unique financial needs and lifestyle demands, making it important for personnel to choose the right credit card. The best credit card for armed forces personnel should offer benefits like low fees, exclusive rewards, cashback on essential spending, fuel surcharge waivers, and travel perks to match their dynamic lifestyle. Many banks in India, including SBI, HDFC, ICICI, and PNB, provide specially designed cards for defense personnel with added privileges. These cards not only ease day-to-day expenses but also recognize the sacrifices of servicemen and women by offering tailored benefits that support their financial well-being.

Why Armed Forces Personnel Need a Special Credit Card

Armed forces personnel lead a life of constant movement, frequent transfers, and unique financial responsibilities, making regular credit cards less suited to their needs. A special credit card for armed forces personnel ensures access to exclusive benefits like lower interest rates, higher insurance coverage, fuel and travel rewards, and easier access to credit even in remote postings. These cards are designed to complement their lifestyle by reducing financial stress and offering recognition for their service. With privileges like cashback, canteen bill payments, and family-friendly perks, such credit cards provide tailored financial support that matches their professional and personal requirements.

Key Features to Look For in a Credit Card

Here are some of the key features of a credit card you should look for. Have a look at them one by one.

1. Annual Fee & Charges – Choose cards with low or zero annual fees to reduce long-term costs.

2. Interest Rates (APR) – A lower interest rate helps save money if you carry forward outstanding balances.

3. Rewards & Cashback – Look for cards that provide cashback, points, or miles on everyday spending.

4. Fuel Surcharge Waiver – Essential for frequent travelers, helping save on fuel expenses.

5. Travel Benefits – Access to airport lounges, free travel insurance, and flight discounts.

6. Insurance Coverage – Higher accidental and life insurance coverage for added security.

7. EMI Facility – Option to convert big purchases into affordable monthly installments.

8. Global Acceptance – Ensure your card is accepted internationally for travel and online shopping.

9. Customer Support – 24/7 helpline and easy dispute resolution are crucial.

10. Special Privileges – Defense-specific perks like canteen bill payments, family benefits, or exclusive tie-ups.

Top Banks Offering Credit Cards for Armed Forces Personnel

1. SBI Shaurya Credit Card

Designed for Indian armed forces personnel, the SBI Shaurya Credit Card offers benefits such as a ₹2 lakh personal accidental insurance cover, fuel surcharge waivers, and the ability to convert outstanding balances into EMIs. Additionally, the card features Easy Bill Pay for utility bill payments.

2. Bank of Baroda (BoB) – Yoddha & Sentinel Cards

BoB offers two credit cards tailored for defense personnel:

Yoddha Credit Card: Exclusively for Indian Army personnel, this card provides benefits like a ₹20 lakh accidental death cover, reward points, and lifestyle privileges.

Sentinel Credit Card: Designed for Assam Rifles personnel, it offers lifestyle and shopping benefits, along with a lifetime-free membership.

3. Punjab National Bank (PNB) – Rakshak RuPay Credit Card

PNB’s Rakshak RuPay Credit Card is crafted for defense personnel, offering features like cashback on CSD purchases, fuel surcharge waivers, and insurance coverage. This card aims to cater to the unique spending patterns of armed forces members.

4. HDFC Bank – Veer Salary Account

While primarily a salary account, HDFC’s Veer Salary Account offers benefits such as zero balance maintenance, monthly interest credits, and eligibility for personal accident death cover. These features complement the financial needs of defense personnel.

5. Kotak Mahindra Bank

Kotak offers the RuPay Veer Platinum and Veer Select credit cards in partnership with NPCI, exclusively for Indian Armed Forces personnel. These cards are contactless, have zero joining fees, and include features like fuel & railway surcharge waivers, reward points, and annual fee waivers.

6. Bank of Baroda (via BOB Financial Solutions Ltd.)

They launched the Yoddha co-branded RuPay contactless credit card, specially for Indian Army personnel. Offered as lifetime-free, it includes features such as welcome/activation/spend-based gifts, domestic airport lounge access, fuel surcharge waiver, and reward points.

7. Axis Bank

Axis Bank’s Pride Platinum Credit Card is specifically tailored for the defence forces and government employees. It offers perks like a fuel surcharge waiver, dining discounts, the ability to convert purchases into EMIs, and free/add-on cards.

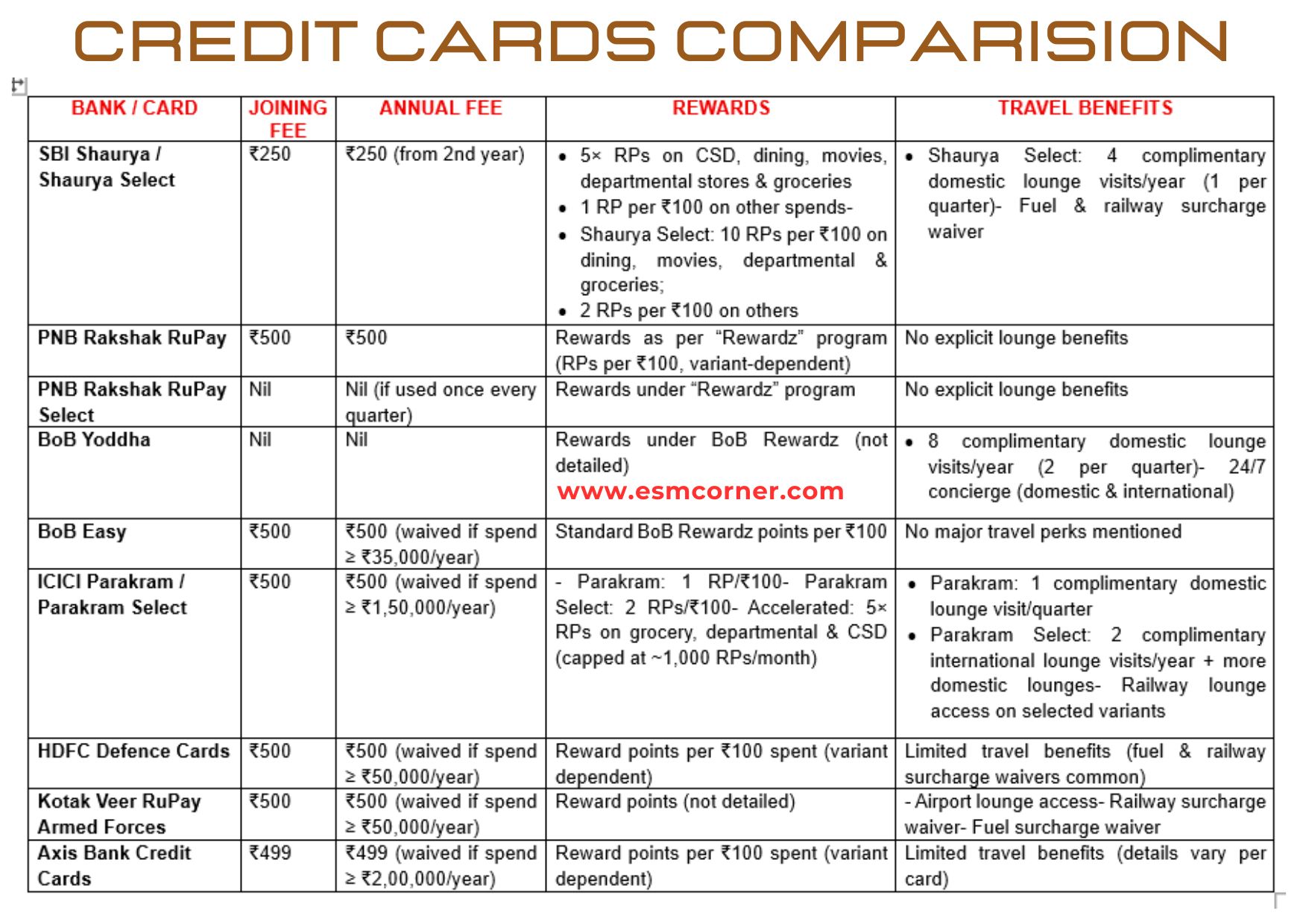

Comparison Table of Credit Cards (SBI vs PNB vs ICICI vs HDFC vs Others)

How to Choose the Right Credit Card as a Defence Personnel

1. Prioritize Military-Specific Benefits

Defence personnel should look for credit cards designed especially for them, offering perks like shopping benefits, fuel surcharge waivers, and higher insurance coverage. These cards often include rewards tailored to frequent travel and family needs, ensuring better financial convenience while acknowledging the unique lifestyle and responsibilities of military members.

2. Check Rewards and Cashback Programs

The right card should maximize value on routine spends such as groceries, dining, fuel, and travel. Defence-specific credit cards often provide accelerated reward points for these categories. Compare programs across banks and choose one where reward points are easy to redeem for vouchers, flights, or outstanding balance payments.

3. Consider Annual Fees and Charges

Since financial planning is crucial for defence families, opt for a card with zero or minimal annual fees. Many banks waive fees for armed forces personnel or provide milestone-based fee reversals. Always compare hidden costs like late payment fees, cash withdrawal charges, and foreign transaction charges before choosing.

4. Evaluate Travel and Insurance Benefits

Frequent postings and travel make lounge access, travel insurance, and accidental cover valuable features. Defence credit cards often provide complimentary lounge visits, air accident insurance, and emergency cover. These benefits ensure comfort and security during both official postings and personal trips, making them an essential factor while selecting a card.

5. Look for Flexibility and Support Services

Choose a credit card with EMI conversion facilities, 24/7 customer care, and global acceptance. Defence personnel are often stationed in remote or foreign locations, so reliable service support and international usability are crucial. A card that simplifies transactions and offers flexibility helps maintain financial stability during demanding service conditions.

Tips for Using Credit Cards Wisely

1. Pay Your Bills on Time

2. Avoid Carrying Unnecessary Balances

3. Track Spending and Stay Within Limits

4. Use Rewards and Cashback Smartly

5. Protect Against Fraud and Misuse

Sum up!

Choosing the best credit card for armed forces personnel depends on balancing rewards, travel perks, insurance, and low fees. Defence-specific cards like SBI Shaurya or ICICI Parakram recognize the unique lifestyle of service members, ensuring financial convenience, security, and benefits that truly honor their dedication and sacrifices.

CENTRAL SAINIK REST HOUSE (CSRH) NEW DELHI: A HOME AWAY FROM HOME

Are these cards for serving personnel or pensioners too

FOR PENSIONERS TOO

How can we Apply

पेन्शन धारकांसाठी सुद्धा आहे असा उल्लेख नाही दिसत.

It is a recognition for defence personnel sacrifices. Thanks

Sbi बँक पेन्शन धारकांना नाही मनते मी एकवेळ विचारले होते.sbi ला डिफेन्स पेन्शन 1996 पासून घेत अहो.

Is there any maximum age limit for allotment of Sainik credit cards?