Introduction

The AGIF Extended Insurance (EI) Scheme, introduced on January 1, 1981, provides crucial financial protection for retired military personnel across the Army, Navy, and Air Force. It covers all ranks who retired after December 31, 1980 (with varying names in each service). For Junior Commissioned Officers (JCOs) and Other Ranks (OR), coverage extends up to age 75, while officers are covered up to age 80. This scheme ensures their financial well-being during the transition to civilian life. In this article, we’ll delve into the EI Scheme offered by the Army Group Insurance Fund In this article we will talk about the EI Scheme offered by Army group Insurance fund.

Let’s explore the scheme’s benefits, necessary documentation, and the role of the Army Group Insurance Fund (AGIF) in offering comprehensive insurance coverage.

Key Features of the AGIF Extended Insurance Scheme

- Coverage Period:

- The EI Scheme covers a specific period, as defined at the time of retirement.

- It applies to retirees based on the cover provided during their service tenure.

- Notably, earlier retirees are not entitled to cover provided by subsequent modifications to the scheme.

- Premium Deduction:

- A one-time non-refundable premium is deducted from the retiring personnel’s benefits.

- Unlike traditional savings plans, the EI Scheme focuses solely on insurance coverage without any survival benefits.

- EI Certificate:

- Upon retirement, the Army Group Insurance Fund (AGIF) issues an EI Certificate to each individual.

- This certificate serves as proof of coverage under the scheme.

- Demise and Claim Process:

- In the unfortunate event of an Ex-Serviceman’s demise, the Next of Kin (NOK) must inform AGIF.

- The NOK needs to provide the death certificate and the EI Certificate for processing the claim.

- Suspension During Re-Employment:

- If a retired individual is re-employed, the EI scheme is suspended.

- The existing insurance scheme then provides the necessary cover during the re-employment period.

What is an EI (Extended Insurance) Certificate :

An EI certificate is issued by Army group Insurance fund at the time of retirement, it contains all the details of the Individual, This certificate holds crucial information:

- Individual Details: It includes personal information about the retiree.

- Nominee and Contingent Nominee: Their names, relationships, and addresses.

- Unique Certificate Number: A distinct identifier.

- Issue Date: When the certificate was granted.

- Insurance Coverage Period: The duration of coverage.

- Additionally, it contains a certificate that must be submitted to AGIF Dte after the insurant’s passing.

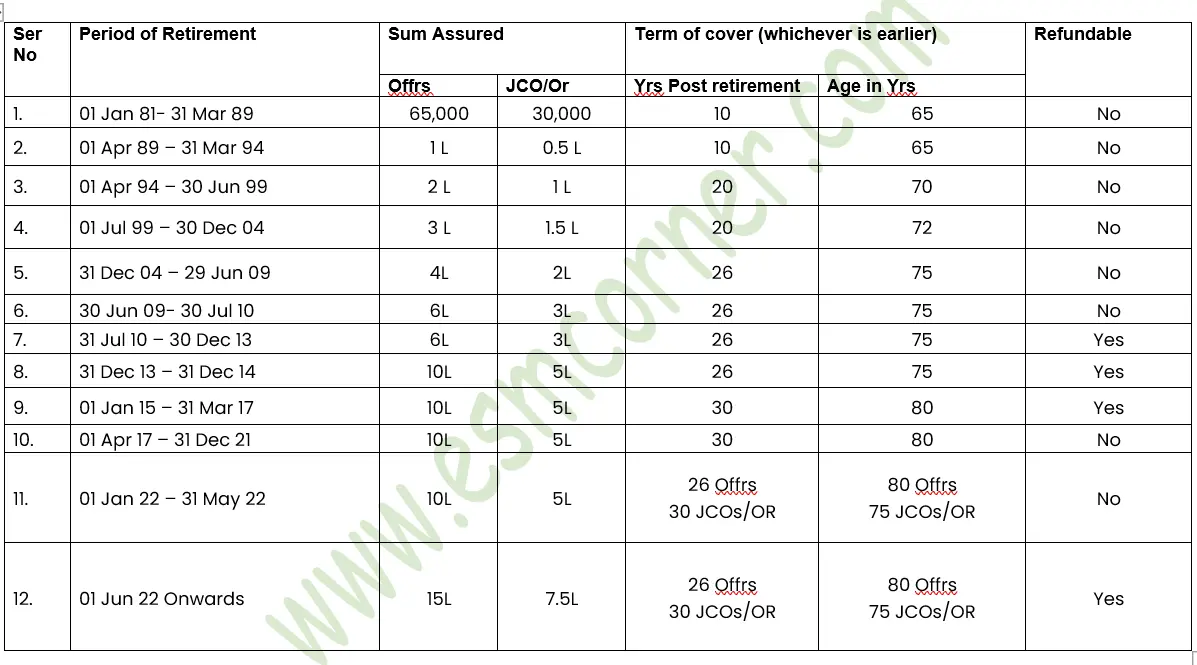

EI Scheme Table

The following table outlines the coverage details for both officers and Junior Commissioned Officers (JCOs) or Other Ranks (OR):

Documents Required for Claiming EI

- Death Certificate:

- Issued by the Registrar of Birth and Death (Military Hospital-issued certificates are accepted).

- Cancelled Cheques or Passbook Copy:

- Ensure that beneficiaries’ names are imprinted on the cheques or passbooks.

- AADHAR Card:

- Required as proof of identity.

- EI Certificate (if available).

- Additional Documents for Non-Nominee/Contingent Nominee Beneficiaries:

- Claim Affidavit (as provided on the website).

- Indemnity Bond with Surety (as provided on the website).

- Ensure that the Sum Assured and Terms of Cover align with the retirement date.

For any queries, please reach out to Army group Insurance fund:

- Email ID: claimsagif@gmail.com

- Mobile Numbers:

- Officers’ Section: 8882484303

- Supdt, EI Section (JCOs/OR): 7290007353

The Fraud in Name of AGIF

Beware of Fraudsters: Be cautious of suspicious phone calls and messages promising to help you retrieve money from Army group Insurance fund. Stay alert and avoid falling victim to scams!

- Important Steps:

- If you receive any suspicious calls, contact AGIF immediately using the numbers below.

- Never deposit cash into any account based on unsolicited requests.

Contact AGIF:

- Director (Coord):

- Civil: 011-26142369, Ext. 206

- Military: 34439

- Director (Claim):

- Civil: 011-26145709, Ext. 404

- Military: 39813

Remember, AGIF will never ask you to deposit cash. Stay informed and protect yourself!

Other Contacts of AGIF

| Contact Details | |

| Help Desk for Loan | 011-26148654 26148055 26143393 26143693 9089384773 7357276788 7290090480 |

| AGIF Exchange | : 011-26142749 26145058 |

| Claims | : Insurance – 7290007425 8882484303 |

| Extended Insurance | : 7290007353 |

| Social Security Deposit | : 7290006489 |

| : claimsagif@gmail.com dir.laon@outlook.com | |

Click here to download form for claiming insurance

Conclusion

In summary, the Extended Insurance (EI) Scheme by AGIF stands as a lifeline for our retired military personnel. As they transition into civilian life, this scheme ensures financial security beyond their active service years. Key features include coverage periods, premium deductions, and the issuance of EI certificates. Remember, AGIF’s commitment to our heroes extends even after retirement. Stay informed, protect your loved ones, and honour their service.

Click here to explore step by step guide on How to claim Army group extended insurance through AGIF

How To Get Duplicate Service Discharge Book: A Detailed Guide

[…] Click here to know more about Extended insurance (EI) scheme by AGIF for ESM […]

[…] Army Group Insurance Fund (AGIF), the spouse or next of kin should write to the AGIF to claim any Extended life insurance benefits. A sample application is often available, which can be used to streamline this process. […]

[…] Click Here to know more about Extended Insurance by AGIF […]