Losing a loved one is incredibly difficult, and dealing with financial matters during such a time can be overwhelming. If you are the nominee or contingent nominee of retired military personnel, the Army Group Extended Insurance (AGIF-EI) can offer much-needed financial support. This step-by-step guide will help you navigate the process of claiming EI insurance through the Army Group Insurance Fund (AGIF).

Click here to know more about Extended insurance (EI) scheme by AGIF for ESM

Step 1: Verify the Validity Period for Army Group Extended Insurance

Before you begin, it’s crucial to check the validity period of the Insurance Certificate. You can only claim the insurance benefits if your spouse’s death occurred within this period. Make sure the date of death falls within the dates specified on the certificate to ensure eligibility.

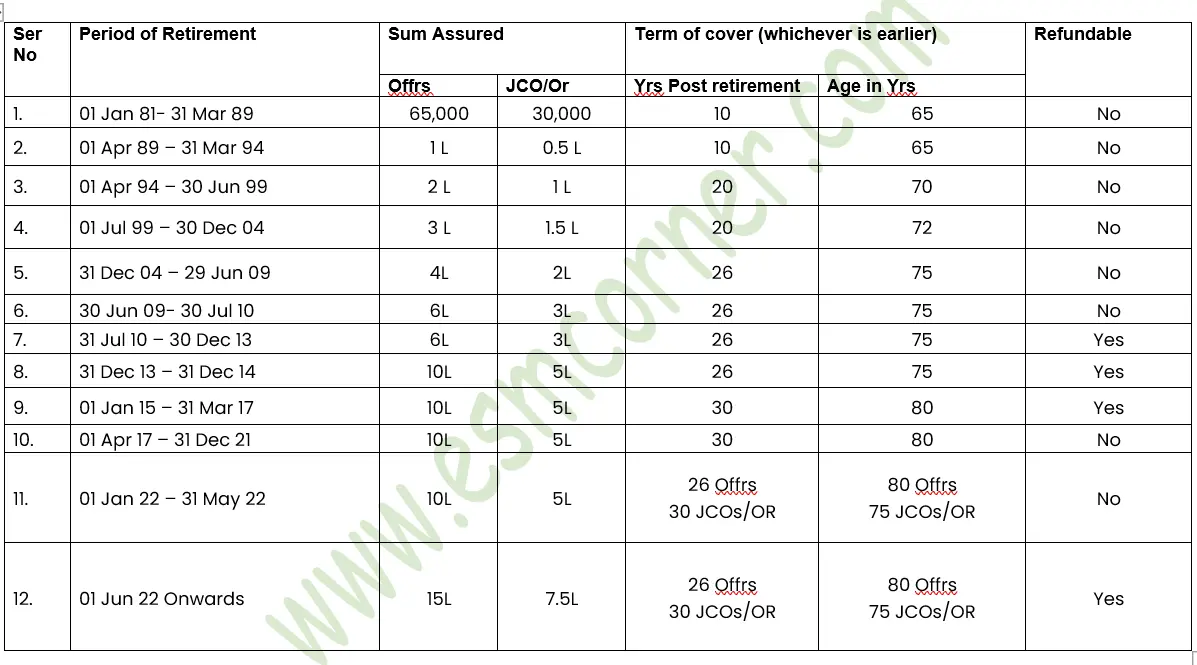

Check the following table to verify the validity period.

Step 2: Gather the Necessary Documents

To process your claim, you will need to collect several important documents. Below, is the list of documents you’ll require (Verify the same from the Claim form by downloading it by clicking here)

- 1. Personal Application:

- Write a hand-written or typed application addressed to the AGI.

- As a nominee/Contingent Nominee you must sign the application. Obtain a recommendation from the Zila Sainik Board (ZSB).

- 2. Original Extended AGI Certificate:

- Sign the certificate and affix a revenue stamp. If you cannot sign, use your Left-Hand Thumb Impression (LTI) in front of a Gazette Officer or ZSB Secretary, who must then authenticate it.

- Include your mobile number below your signature for easy contact.

- A sample application format is provided by the AGI for reference in Pdf format

- 3. Death Certificates: Obtain death certificate:

- It should be from the doctor or hospital, specifying the cause of death. Duly signed by you and attested by the ZSB Secretary. (This may vary from State to State for precise Information please visit your concerned ZSB)

- For unnatural deaths, you must also provide attested copies of the First Information Report (FIR), post-mortem report, and police investigation report.

- 4. Bank Passbook:

- Provide the first page of your bank account passbook, ensuring your name, account number, and IFSC Code are visible.

- If the passbook is unavailable, an original cancelled cheque from your bank account will suffice.

- 5. Photocopies of Identification:

- Self-attest photocopies of your Aadhaar Card and PAN Card.

Click here to download the form for claiming AGIF

Step 3: Visit the Zila Sainik Board (ZSB)

With all your documents prepared, visit the ZSB. The Officer in Charge will verify your documents and provide a recommendation. Keep one copy of the application for your records.

Step 4: Send Documents to AGI

Next, you need to send one copy of the personal application along with all the required documents to the Army Group Insurance Office via Post Office Speed Post. Use the following address:

ARMY GROUP INSURANCE FUND

AGI BHAWAN, Post Bag No. 14 Vasant Vihar Opp Signals Enclave

Rao Tula Ram Marg,

New Delhi-110057

(Through ZSB)

Contact details of AGIF

| Contact Details | |

| AGIF Exchange | 011-26142749 26145058 |

| Claims | Insurance – 7290007425, 8882484303 |

| Extended Insurance | 7290007353 |

| claimsagif@gmail.com & dir.laon@outlook.com | |

Step 5: Receive Direct Credit

Once AGI receives your documents, they will process your claim. The insurance amount will be directly credited to your bank account. If there are any issues or queries, the AGI staff will contact you by phone to resolve them.

Conclusion

Navigating financial procedures during a time of loss can be daunting, but AGIF is dedicated to supporting you through this challenging period. The EI-AGI is designed to provide essential financial assistance to ensure your security and well-being. By following this comprehensive guide, you can successfully claim the benefits you are entitled to, thereby easing some of the financial burdens during this difficult time. Trust in AGIF’s commitment to stand by you and provide the necessary support you need.

UNDERSTANDING AWWA & ITS CONTRIBUTION TO VEER NARIS

[…] Click here to explore step by step guide on How to claim Army group extended insurance through AGIF […]

Extended AGI Certificate not received on retirement. How can be claimed.

You may obtain the required information by filing an RTI application with your Record Office; they will subsequently forward it to AGIF for necessary action.

[…] ALSO READ I How to claim Extended AGIF Insurance […]