Serving defence personnel, veterans, and family pensioners have banking needs that are very different from civilian customers. Frequent transfers, field postings, pension issues, SPARSH coordination, loan documentation, and retirement-related banking matters often require specialised understanding. To address these unique requirements, many major Indian banks have appointed Defence Banking Advisors (DBAs).

A Defence Banking Advisor acts as a dedicated link between the defence community and the bank, ensuring smooth, respectful, and timely banking support.

What Is a Defence Banking Advisor?

A Defence Banking Advisor (DBA) is a senior official appointed by a bank to specifically look after the banking needs of:

- Serving Army, Navy, and Air Force personnel

- Ex-Servicemen (ESM) and veterans

- Family pensioners

- Widows and dependents of defence personnel

In most cases, DBAs are retired senior defence officers or experienced senior bankers, which helps them understand both military systems and banking procedures.

Banks like SBI, Bank of Baroda, and PNB have institutionalised this system to improve service delivery to the defence fraternity.

Why Defence Banking Advisors Are Important

Defence personnel face several practical banking challenges, such as:

- Pension account issues after retirement

- SPARSH-related pension coordination

- Change of bank or branch due to relocation

- Defence salary package queries

- Housing, vehicle, education, and personal loans

- Documentation issues during postings and retirement

- Family pension and nominee-related banking problems

A Defence Banking Advisor understands military service conditions, pension rules, and defence-specific banking products, which makes problem resolution faster and more effective than routine branch escalation.

Key Roles and Responsibilities of a Defence Banking Advisor

A Defence Banking Advisor typically performs the following functions:

- Acts as a single point of contact for defence-related banking matters

- Coordinates between bank branches and defence customers

- Assists in pension account issues, including SPARSH-linked cases

- Supports defence salary package implementation

- Helps in resolving complaints and service delays

- Guides veterans during retirement transition and financial planning

- Liaises with defence units, stations, and veteran organisations

In many cases, DBAs also conduct financial awareness sessions for serving personnel and veterans.

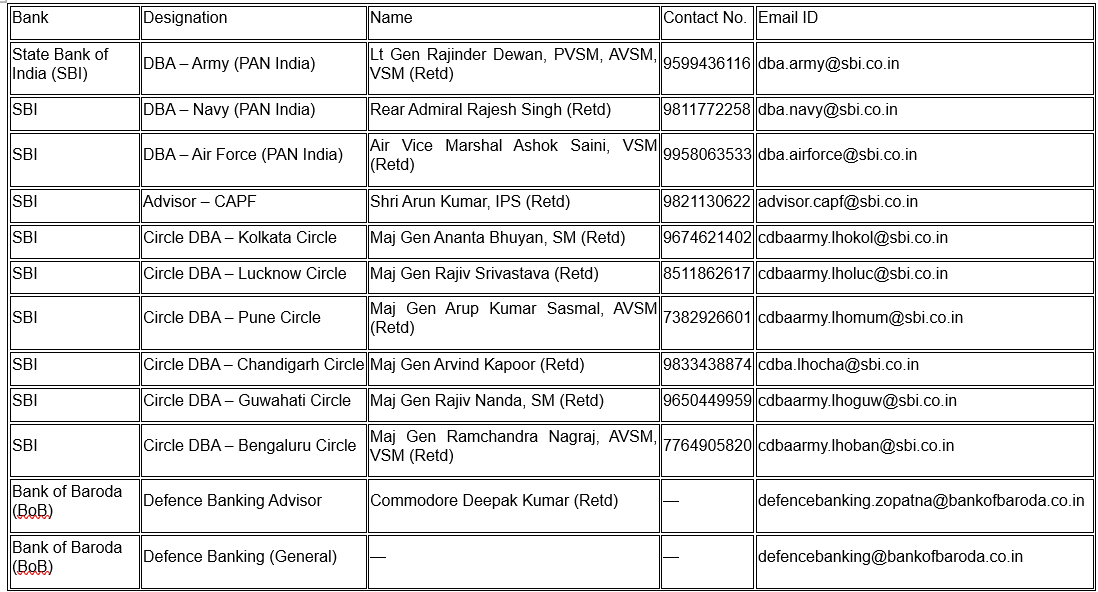

Defence Banking Advisor Contacts – Major Indian Banks

Below is a ready reference table of Defence Banking Advisor contacts for major banks. These contacts are especially useful when branch-level issues are not resolved.

DBA Contact Details

When Should Veterans Contact a Defence Banking Advisor?

You should consider contacting a Defence Banking Advisor if:

- Pension issues are not resolved at branch level

- SPARSH-linked banking problems are delayed

- Defence salary package benefits are denied

- Loan or documentation issues remain unresolved

- You need guidance during retirement or pension transition

Always try the branch first, but DBAs are the correct escalation channel when routine methods fail.

👉 ALSO READ I 10 MUST-KNOW BENEFITS AND UPDATES FROM THE DIRECTORATE OF CANTEEN SERVICES IN 2026

How to Contact Effectively

When emailing or calling a DBA:

- Clearly mention your name, service number, PPO number (if pensioner)

- Provide bank name, branch, and account details

- Briefly explain the issue with dates

- Attach relevant documents if emailing

Clear and factual communication helps in quicker resolution.

Conclusion

Defence Banking Advisors play a crucial but often under-utilised role in supporting India’s defence community. They bridge the gap between complex banking systems and the unique realities of military life. Whether it is pension, salary, loans, or retirement-related banking issues, DBAs ensure that those who served the nation receive dignified, informed, and timely banking support.

Every serving member, veteran, and family pensioner should be aware of this facility and use it whenever needed.

Q1. What is a Defence Banking Advisor (DBA)?

A1. A Defence Banking Advisor is a senior bank official appointed to handle banking issues of serving personnel, veterans, and pensioners. The DBA acts as a dedicated escalation point for defence-related banking matters.

Q2. Who can contact a Defence Banking Advisor?

A2. Serving Army/Navy/Air Force personnel, Ex-Servicemen (ESM), veterans, widows, and family pensioners can contact a DBA. Defence dependents facing pension account issues can also seek help.

Q3. When should a veteran contact the DBA instead of the branch?

A3. Contact the DBA when your issue is not resolved at branch level, especially pension delays, service denial, SPARSH-linked delays, or unnecessary documentation demands. Always try the branch first and keep proof of complaint.

Q4. Can a DBA help with SPARSH-related pension problems?

A4. Yes. Many SPARSH cases get delayed due to bank-side issues like verification, account mapping, or pension credit problems. DBAs coordinate internally with branches and pension cells for faster action.

Q5. What issues are solved faster through a DBA?

A5. DBAs help quickly in pension stoppage/delay, wrong bank charges, defence salary package disputes, nominee/family pension problems, and branch-level non-cooperation. They also support in banking documentation issues.

Q6. How to contact a DBA for quick resolution?

A6. Share your name, service number, PPO number (if pensioner), bank/branch details, issue summary with dates, and complaint reference number. Attach proof like bank replies, statement extract, and screenshots.

Q7. Is DBA support free? Do I need an agent or lawyer?

A7. DBA support is free and does not require any agent or lawyer. Always use official bank email/contacts and avoid sharing sensitive details with unknown persons.

Q8. What if the DBA also does not resolve my issue?

A8. Escalate through the bank grievance portal/nodal officer and then approach the RBI Ombudsman if eligible. Keep all complaint records and communication proofs.

Sir, GM

I have been timely updated my life certificate digitally on 04.10.2025 & showing portfolio already submitted, thereafter my pension has not been credited to my account. However I have been resubmitted on 01.02.2026 & shared the mail to Sparsh.

Like to know GREF/BRO Veterans (Army/ MoD ) can also make use of services of Defence Banking Advisors.