Introduction :Tax Exemption on Disability Pension

A ruling by Central Board of Direct Taxes (CBDT) has clarified an important matter for armed forces personnel: the tax exemption status of “disability pension.” This article explores different aspects of disability pensions, legal precedents, and the ongoing issues related to tax exemption. The goal is to help those affected gain a clear understanding of their entitlements and the legal landscape.

What is Disability Pension?

Disability pension in the Indian Armed Forces is a vital financial support system for personnel who have experienced disabilities during their service. It ensures that veterans who can no longer serve due to permanent impairments or service-related injuries receive financial assistance. The pension amount varies depending on how severe the disability is.

The term “disability pension” is not explicitly defined under the Income Tax Act, nor is there a specific provision that exempts it from taxation. Section 10 of the Income Tax Act exempts various types of income, including certain pensions for Gallantry Award winners, under sub-sections 18 and 19. However, it does not mention anything about the disability pension for army personnel.

The armed forces provide pensions not only for disabilities attributable to or aggravated by service conditions but also another type called “invalid pension.” This invalid pension is granted to individuals who are invalided out of service due to reasons other than war, battle, or service conditions. To qualify for an invalid pension, a person must have completed a qualifying service of 10 years or more and must have a disability that is neither attributable to nor aggravated by service (NANA). In such cases, the individual may receive the service element of the pension but not the disability element.

Types of Disability Pension & Its Computation

Disability pensions consist of two parts: the Service Part and the Disability Part. These parts are computed separately and have separate pension pay orders (PPOs). The service part is similar to a normal retirement pension and is fixed at 50% of the last pay drawn. The disability part, however, is determined by the percentage of disablement as assessed by the Release/Invalid Medical Board (RMB/IMB).

A person may receive both a normal retirement pension (subject to meeting the qualifying service period) and a disability pension. The computation of the disability part depends on the extent of disablement as determined by the RMB/IMB.

Types of Disability Pension

There are two primary types of pensions provided by the armed forces related to disability:

1. Invalid Pension: Granted to individuals who have completed a qualifying service of 10 years or more and are invalided out of service with a disability that is neither attributable to nor aggravated by service (NANA). These individuals receive the service element of the pension but not the disability element.

2. Disability Pension: This pension has two components – the service part and the disability part. The service part is similar to a normal retiring pension, fixed at 50% of the last pay drawn. The disability assessment is based on the percentage of disablement determined by the Release/Invalid Medical Board (RMB/IMB). This assessment plays a crucial role in determining the disability pension for armed forces personnel.

Computation of Disability Pension

The computation of disability pension varies based on the extent of disability and whether the disability was incurred during war/battle or other conditions:

– War/Battle Disabled Personnel:

– 21% to 50% disability: 50% of the last pay drawn

– 51% to 75% disability: 75% of the last pay drawn

– Exceeding 75% disability: 100% of the last pay drawn

– Other Than War/Battle Disabled Personnel:

– 21% to 50% disability: 15% of the last pay drawn

– 51% to 75% disability: 22.5% of the last pay drawn

– Exceeding 75% disability: 30% of the last pay drawn..

Tax Exemption on Disability Pension

The issue of tax exemption on disability pension has been addressed through various instructions and circulars issued by the Central Board of Direct Taxes (CBDT). Notably, Instruction No. 2/2001 (dated 02 July 2001) and Instruction No. 136 (dated 14 January 1970) have clarified that both elements of the disability pension—the service element and the disability element—are exempt from income tax. This exemption provides financial relief to disabled armed forces personnel.

Key Instructions and Circulars

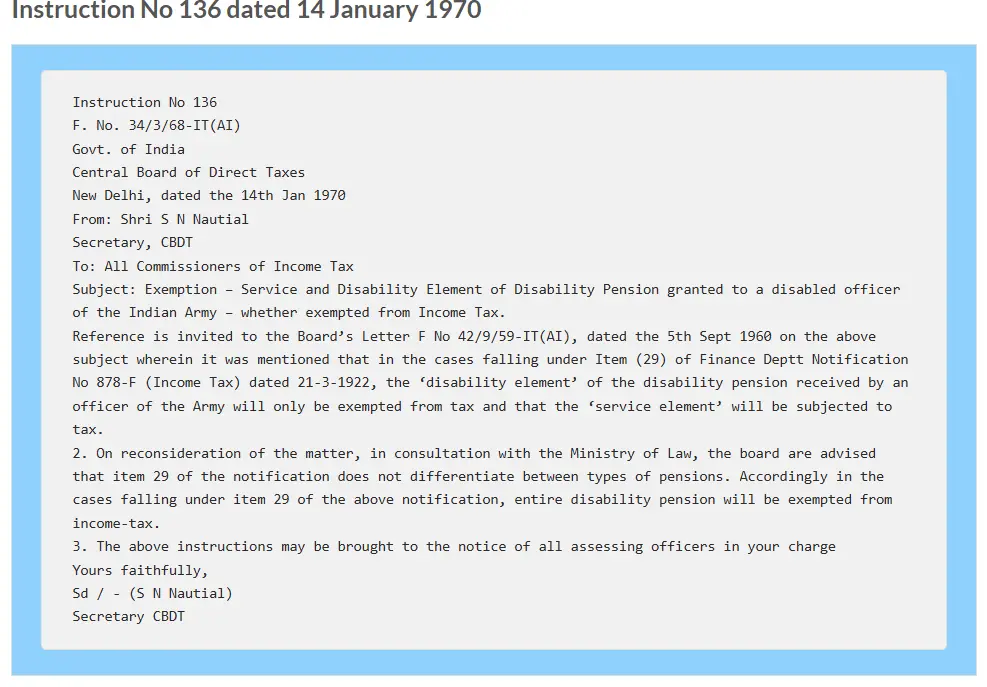

– Instruction No. 136 (14 January 1970): Initial Tax Exemption on Disability Pension

Initially, it was stated that only the disability element of the disability pension would be exempt from tax. However, upon reconsideration, it was clarified that the entire disability pension is exempt from tax.

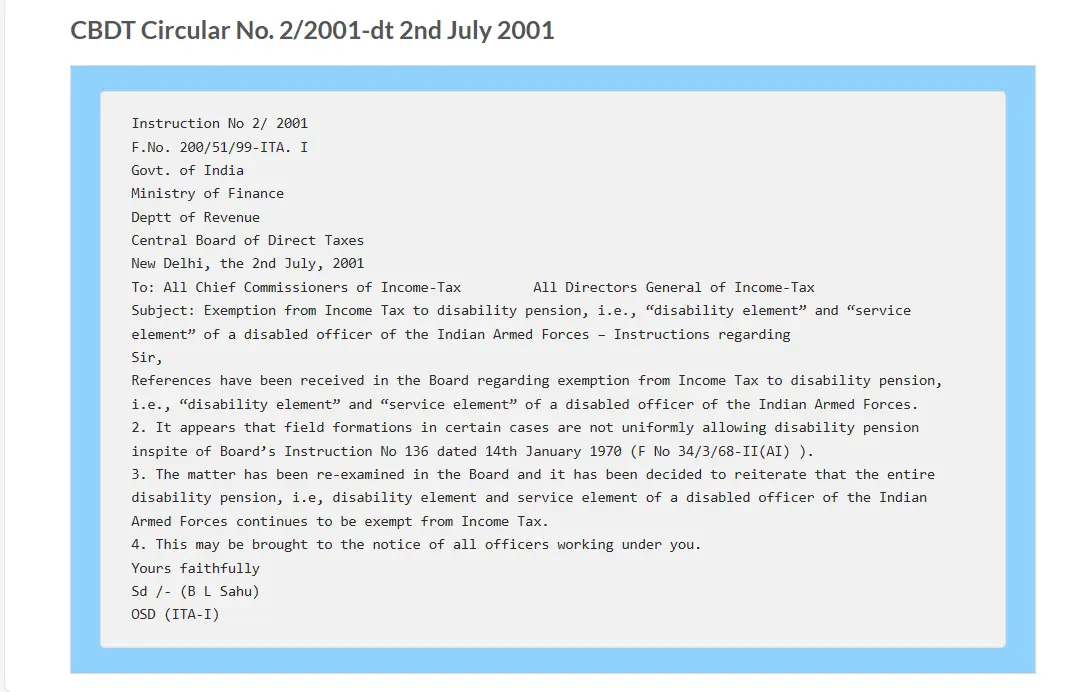

Instruction No. 2/2001 (02 July 2001): Tax Exemption on Disability Pension

Reiterated that both the service element and the disability element of the disability pension for armed forces personnel are exempt from income tax.

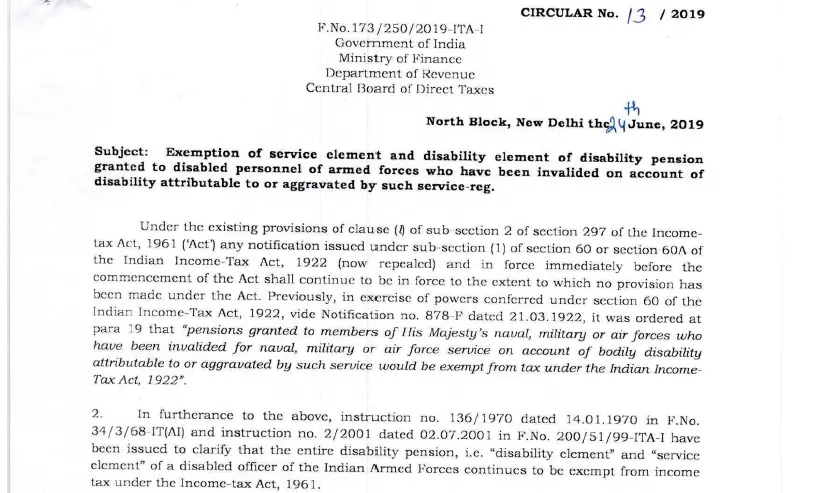

Circular No. 13/2019 (24 June 2019): Tax Exemption on Disability Pension

This circular created confusion by stating that the tax exemption would only apply to armed forces personnel invalided from service due to bodily disability attributable to or aggravated by service and not to those who retired on superannuation or otherwise. This led to significant uncertainty and required clarification.

Click here to download Circular number 13/2019

Supreme Court Intervention on Tax Exemption on Disability Pension

The Supreme Court stayed Circular No. 13/2019, which means that until a final decision is made, Instruction No. 2/2001 remains in effect. This implies that the entire disability pension continues to be exempt from income tax. The stay order ensured that no changes would be implemented that could potentially harm the financial well-being of affected personnel.

Case Laws Supporting Tax Exemption

Several case laws have supported the Tax Exemption on Disability Pension , reinforcing the position that these pensions should not be subject to income tax:

1. Col. Jaswinder Pal Singh (Retd) vs PCIT – Punjab & Haryana Court:

The court ruled in favor of the petitioner, reinforcing Tax Exemption on Disability Pension. This case set a significant precedent and provided clarity for similar cases in the future.

2. Shri Aradhya Ghosh vs Deputy Commissioner of Income-tax:

The tribunal ruled that no TDS should be made on the disability pension, even if the retirement was voluntary. This ruling provided relief to many personnel who opted for voluntary retirement and were still facing tax deductions on their disability pensions. it is one of the important judgement on Tax Exemption on Disability Pension

3. Manish Roy, Bangalore vs Income-Tax Officer:

The tribunal provided relief to the assesses, following the precedent set in the case of Shri Aradhya Ghosh. This case further solidified the stance that disability pensions should not be taxed, providing consistency in rulings across different cases.

Government Position on TDS

The Ministry of Defence, following the Supreme Court’s stay order, directed that no TDS (Tax Deducted at Source) should be made on disability pensions until the Supreme Court makes a final decision. This directive was communicated through Circular No. 211 dated 03 March 2020 issued by PCDA (Pensions) Allahabad. This move ensured that armed forces personnel would not face immediate financial deductions while the legal proceedings were ongoing.

Click here to read more on INCOME TAX RETURN (ITR) FILING : AN OVERVIEW

Conclusion

The exemption of disability pension from income tax remains a critical issue for armed forces personnel. While Circular No. 13/2019 attempted to restrict the exemption, the Supreme Court’s intervention ensures that Instruction No. 2/2001, which exempts both the service and disability elements of the pension, remains valid. Until the final outcome of the ongoing legal proceedings, the entire disability pension continues to be tax-free….

Click here to join us on Whatsapp for INCOME TAX RETURN FILING (ITR)

Key Takeaways :Tax Exemption on Disability Pension

- Both the service and disability elements of the disability pension are exempt from income tax. This provides significant financial relief to affected personnel, ensuring that they receive their full entitlements without deductions.

- This exemption applies to all armed forces personnel, regardless of rank, who have been invalided from service due to a disability attributable to or aggravated by service conditions. This inclusive approach ensures that no personnel are unfairly excluded from these benefits.

- The Supreme Court’s stay on Circular No. 13/2019 means that the existing tax exemptions remain in place until further notice. This provides stability and certainty for affected personnel, allowing them to plan their finances without concern over potential changes.

- Armed forces personnel receiving disability pensions should remain informed about the latest legal developments to ensure they receive the benefits they are entitled to without unnecessary tax deductions. Staying updated on these issues can help personnel and their families better navigate the complexities of tax laws and secure their financial well-being.

[…] Also Read I Tax Exemption on Disability Pension For Armed Forces Personnel […]