Imagine having a personal diary that keeps track of every tax transaction you’ve made over the year. That’s what Form 26AS is for Indian taxpayers. It’s a yearly summary that you can easily get online with your PAN number. This form is really important because it has all the details about the taxes taken out of your pay and shows that your taxes have been paid.

In this article, we’ll talk about why Form 26AS is a key document for military veterans. They need to submit it every year so that their family members who are older than 18 and their parents can use the health care services provided by ECHS.

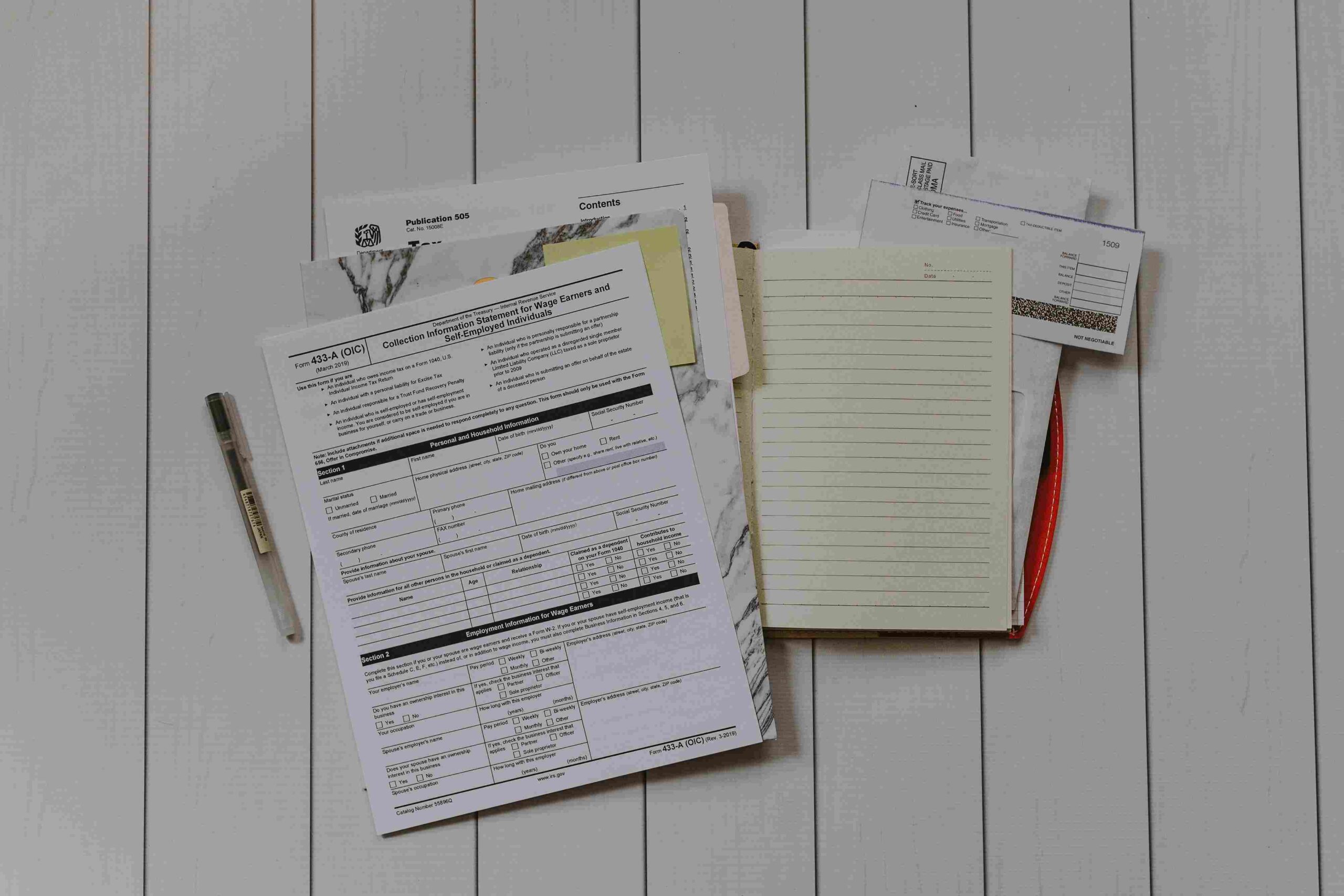

What is Form 26AS?

Form 26AS is a tax credit statement that includes comprehensive details of taxes deducted at source (TDS), taxes collected at source (TCS), advance tax payments, self-assessment tax payments, and high-value transactions for a particular financial year. This form also shows details about any income tax refunds you’ve gotten during the financial year, as well as any ongoing or finished tax assessments.

What Does Form 26AS Reflect?

The form provides a detailed account of:

- TDS deducted by employers, banks, or other organizations.

- TCS collected by sellers.

- Advance tax/self-assessment tax that you have paid.

- Details of the refund received from the income tax department.

- High-value transactions in shares, mutual funds, etc.

- Any tax demands or arrears against your PAN.

Why is Form 26AS Necessary?

Form 26AS is indispensable for several reasons:

- Verification: It allows taxpayers to verify the tax deducted and ensure that the correct amount of tax has been deposited to the government treasury against their PAN.

- Tax Filing: It is a vital document for accurate income tax return filing, as it helps reconcile the taxes paid and TDS/TCS credits with the income tax return.

- Transparency: It provides transparency and helps in preventing tax evasion by keeping a record of all high-value transactions.

- Refund Claims: If there is excess TDS or TCS, taxpayers can claim a refund from the Income Tax Department based on the information in Form 26AS.

How to Download Form 26AS?

Here’s a simple guide to accessing and downloading your Form 26AS:

Start by Signing In:

- Head over to the official Income Tax e-filing website. https://www.incometax.gov.in.

- Press the ‘Login’ button.

- Type in your PAN or Aadhaar number, your password, and the captcha code to sign in.

Locate Form 26AS:

- After logging in, find the ‘e-file’ section and choose ‘Income Tax Returns’.

- Look for the option ‘View Form 26AS (Tax Credit)’ and click it.

Enter the TRACES Portal:

- Take a moment to read the disclaimer, then confirm.

- You’ll be taken to the TRACES portal. Here, agree to the terms and conditions to continue.

Downloading Your Form:

- Pick the ‘Assessment Year’ you need and decide how you want to view the form (HTML, Text, or PDF).

- Hit the ‘View/Download’ button to see your Form 26AS.

- If you want a PDF, first open the form in HTML format, then select ‘Export as PDF’ to download it.

And that’s it! You’ve got your Form 26AS ready to review.

Worried about tax filing….. need not to be … File your Tax with Us…..

click here to join ESM Corner Tax ITR Community

ESM CORNER ITR SOLUTION.

Why Form 26 AS is an important document for Veterans

For Indian armed forces veterans, form 26AS is vital for the annual validation of ECHS cards every October. Dependents above 18 and parents earning below ₹9,000 per month, excluding DA, must validate to avail of ECHS benefits. Male children up to 25 years and unmarried female children are eligible, provided they meet the income criteria. Submitting Form 26AS or state-provided income proof is mandatory for validation. Dependents must have a PAN card linked to their Aadhaar and mobile number to create an ID on the Income Tax website, ensuring seamless access to ECHS facilities.

Conclusion

In short, Form 26AS is a tax record that’s crucial for everyone, including military veterans. It confirms taxes paid, ensuring honesty and transparency. For veterans, it’s essential to secure ECHS health benefits for their families and verify income eligibility. This form simplifies tax management in our digital age, offering financial clarity and security.