The Indian government’s recent approval of the Unified Pension Scheme (UPS) is a major milestone in improving the country’s social security system. The UPS is designed to provide a more reliable and comprehensive pension plan for government employees by combining existing pension schemes into one unified system. This article explores the main features of the UPS, its importance, potential challenges, and how it differs from the Old Pension Scheme (OPS) and the National Pension System (NPS).

Key Features of the Unified Pension Scheme (UPS)

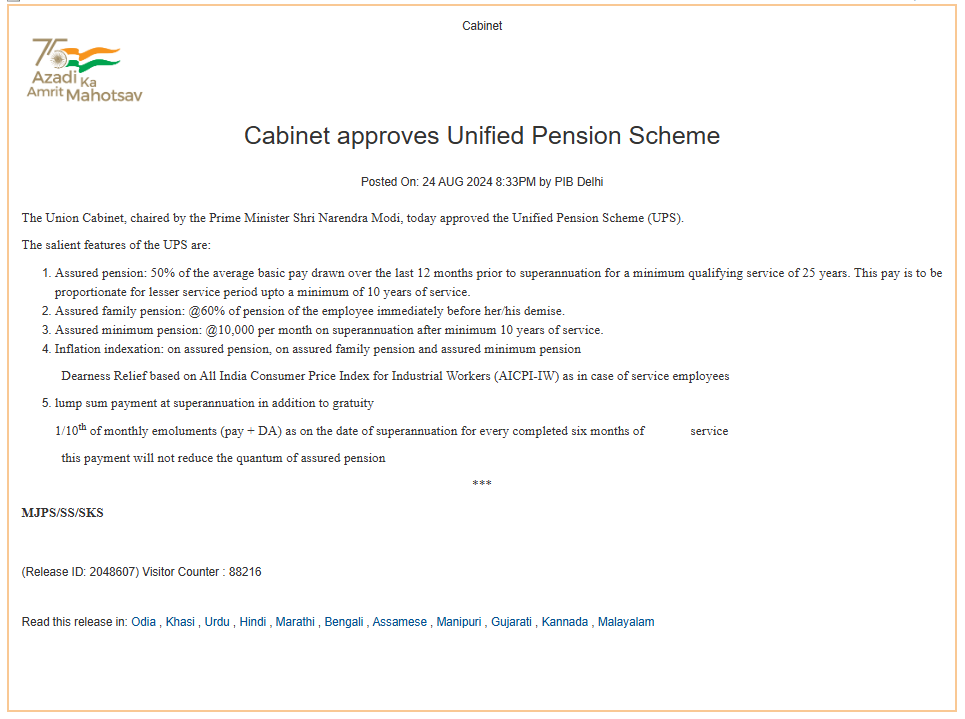

The Unified Pension Scheme is designed to offer a more stable and predictable pension system for government employees. Here are its key features:

- Assured Pension: Government employees will receive 50% of their average basic pay from the last 12 months before retirement, provided they have completed at least 25 years of service. Those with less than 25 years but at least 10 years of service will receive a proportionate amount.

- Assured Family Pension: After the employee’s death, their family will receive 60% of the pension that the employee was receiving at the time of their passing.

- Assured Minimum Pension: A minimum pension of ₹10,000 per month will be provided upon retirement, as long as the employee has served for at least 10 years.

- Inflation Indexation: The assured pension, family pension, and minimum pension will be adjusted for inflation. This will be based on the Dearness Relief (DR) linked to the All India Consumer Price Index for Industrial Workers (AICPI-IW), similar to the adjustments made for serving employees.

- Lump-Sum Payment at Superannuation: In addition to gratuity, employees will receive a lump sum payment of 1/10th of their monthly emolument (pay + DA) for every completed six months of service at the time of retirement. This lump sum will not reduce the amount of the assured pension.

Other Key Features of the Unified Pension Scheme (UPS)

- Applies to Past Retirees: The UPS provisions will also apply to those who retired under the National Pension System (NPS) and have already superannuated.

- Arrears with Interest: Any arrears for the past period will be paid with interest at Public Provident Fund (PPF) rates.

- Optional for Employees: Both current and future employees will have the choice to join either the NPS or the UPS. Once an employee makes a choice, it cannot be changed.

- No Increase in Employee Contribution: Employees will not have to contribute more than they currently do. The government will cover the additional cost required to implement the UPS.

- Higher Government Contribution: The government’s contribution to the pension fund will increase from 14% to 18.5%.

Implementation of UPS

- Implementation Date: The UPS will take effect from April 1, 2025.

- Central Government Rollout: The UPS will be implemented by the Central Government, benefiting 2.3 million (23 lakh) central government employees.

- State Government Adoption: The same framework is available for state governments to adopt.

- Potential State Benefits: If state governments adopt the UPS, it could benefit over 9 million (90 lakh) government employees currently on the NPS.

How the Unified Pension Scheme Differs from OPS and NPS

The UPS seeks to address the shortcomings of both the Old Pension Scheme (OPS) and the National Pension System (NPS) by providing a more unified and efficient pension system. Here’s how the three schemes compare:

| Feature | Old Pension Scheme (OPS) | National Pension System (NPS) | Unified Pension Scheme (UPS) |

| Nature of Scheme | Defined Benefit Scheme | Defined Contribution Scheme | Combines Features of OPS and NPS |

| Pension Amount | 50% of the last drawn salary | Depends on the accumulated corpus | 50% of the average basic pay for last year |

| Employee Contribution | None | Employee and government contributions | Likely includes contributions from both |

| Government Funding | Fully funded by the government | Market-linked returns | More financially sustainable than OPS |

| Portability | Non-portable | Portable across jobs | Portable across jobs and locations |

| Inflation Adjustment | DA-linked adjustment | Market-dependent returns | Indexed to inflation (AICPI-IW) |

| Guaranteed Minimum Pension | Yes, but only for government employees | No guaranteed minimum pension | Guaranteed minimum pension |

Implications for Defence Personnel: Opportunities and Uncertainties

The introduction of the Unified Pension Scheme brings several important questions for defence personnel. Will they continue under the Old Pension Scheme (OPS), or will they have the option to switch to the UPS? Additionally, for Short Service Commission (SSC) officers who retire after 10 years, will the UPS be an option, and how will it affect their retirement benefits?

The scheme’s applicability to those invalidated or discharged from the Army is also uncertain. However, the UPS could offer significant advantages to armed forces veterans who seek second careers after their military service. It may provide a stable pension while allowing them to work for up to 18 to 20 years. The sectors likely to benefit most from the UPS are the paramilitary forces and the Coast Guard, where personnel often have longer service and thus stand to gain substantially from the new pension structure.

Will defence personnel be able to switch to UPS from OPS? And will SSC officers retiring after 10 years find the UPS beneficial? These questions remain to be answered as the scheme unfolds.

Conclusion

The Unified Pension Scheme marks a significant advancement in the Indian government’s effort to improve the social security system for its workforce. By combining the strengths of the Old Pension Scheme (OPS) and the National Pension System (NPS), the UPS aims to create a more balanced pension system that offers both security and flexibility for retirees. With its emphasis on inclusivity, portability, and financial literacy, the UPS addresses many of the issues found in India’s current pension schemes. If implemented successfully, it has the potential to provide a more secure, stable, and sustainable retirement system for millions of government employees across the country.

Frequently Asked Questions (FAQs)

Q1. What is the Unified Pension Scheme?

The Unified Pension Scheme is a comprehensive pension framework approved by the Indian government to unify and streamline various existing pension schemes into a single system. It ensures a stable and predictable pension for government employees, combining the benefits of the Old Pension Scheme (OPS) and the National Pension System (NPS).

Q2: What benefits does the Unified Pension Scheme offer?

Under the UPS, retirees will receive a pension equal to 50% of their average basic pay from the last 12 months of service, if they have completed at least 25 years of service. For those with 10 to 25 years of service, the pension amount will be adjusted based on the length of their service.

Q3: Who will benefit from the Unified Pension Scheme ?

The UPS will immediately benefit 2.3 million central government employees. If state governments also adopt the scheme, it could potentially extend these benefits to over 9 million employees across various states.

Q4. How does the Unified Pension Scheme differ from OPS and NPS?

The UPS combines the benefits of OPS and NPS. While OPS offers a guaranteed pension funded entirely by the government, and NPS is a market-linked scheme with employee contributions, the UPS offers a balanced approach with a guaranteed minimum pension and market-linked growth.

Q5. Is the Unified Pension Scheme financially sustainable?

The UPS is designed to be financially sustainable by involving both employee contributions and government support. This reduces the long-term financial burden on the government, unlike the OPS, which was not fiscally sustainable.

Q6. Will the Unified Pension Scheme be portable?

Yes, one of the key features of the UPS is the portability of benefits, allowing employees to carry their pension entitlements across different jobs and locations.

Q7: What benefits could the Unified Pension Scheme (UPS) offer to armed forces veterans looking for new careers?

A7: The Unified Pension Scheme can be very helpful for armed forces veterans who want to start new careers after leaving the military. It offers a stable pension and allows veterans to work in new jobs for up to 18 to 20 years. This is especially useful for those joining central government jobs or paramilitary forces, as the UPS provides good benefits for people with longer service periods.

Q8: Which sectors are likely to benefit the most from the Unified Pension Scheme (UPS)?

A8: The sectors that will benefit the most from the Unified Pension Scheme (UPS) are likely to be the paramilitary forces and the Coast Guard. Employees in these areas often serve for longer periods, and the UPS is designed to give more benefits to those with longer service.

ALSO READ I WHAT IS THE PROPOSED “YUDH SAMMAN YOJANA”?

Do You want to stay updated on All Post Retirement affairs and welfare news click here to join our WhatApp group