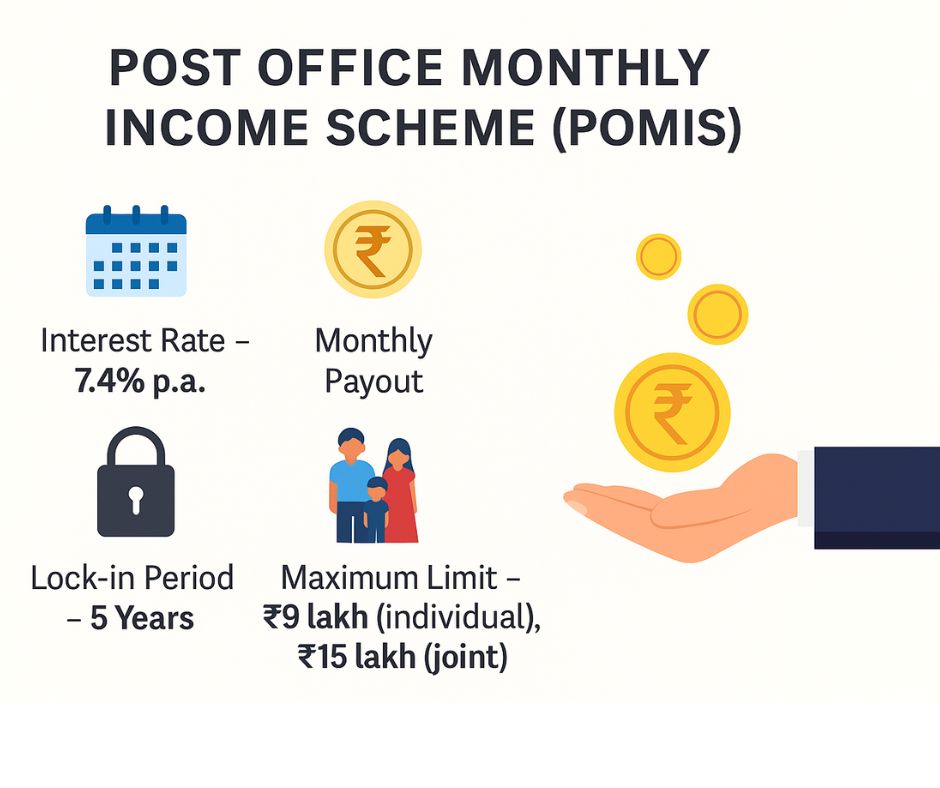

If you’re looking for a government-backed savings scheme that gives guaranteed monthly income, the Post Office Monthly Income Scheme (POMIS) is a great option. It’s simple, safe, and ideal for people who want regular income without taking risks.

✅ What is Post Office monthly Income Scheme (POMIS)?

India Post provides a savings scheme known as the Post Office Monthly Income Scheme (POMIS), which offers individuals a steady monthly income. Under this scheme, you invest a lump sum amount and receive interest every month for a period of five years. At the end of five years, your original investment (called the principal) is returned to you.

This scheme is managed by the Government of India, which makes it extremely safe and reliable.

💰 Current Interest Rate

As of August 2025, POMIS offers an interest rate of 7.40% per annum. The interest is paid to you monthly, making it a perfect choice for senior citizens, homemakers, or anyone who needs a steady monthly income.

🔐 Lock-in Period and Tenure

The scheme has a tenure of five years, during which the principal amount cannot be withdrawn This means you cannot withdraw your full amount before 5 years without penalty. However, in certain situations, premature closure is allowed after 1 year (with deductions).

Once the five-year term ends, investors have the option to either withdraw their funds or renew the scheme for an additional five years.

🧾 Investment Limits

- Minimum Investment: ₹1,000

- Maximum Investment (Single Account): ₹9 lakh

- Maximum Investment (Joint Account): ₹15 lakh

Joint accounts can be opened by two or three adults, and the income is equally divided among the account holders.

A minor account can also be opened in the child’s name, provided the child is at least 10 years old . When they turn 18, the account is transferred to their name.

💵 Monthly Income Example

If you invest ₹9 lakh (maximum for a single account), you’ll earn:

Monthly Income = ₹9,00,000 × 7.4% ÷ 12 ≈ ₹5,550

So, every month you will receive ₹5,550 as interest, and after 5 years, you’ll get your ₹9 lakh back.

📝 How to Open a POMIS Account

To open a POMIS account:

- Visit your nearest post office.

- Ensure you have a Post Office Savings Account.

- Fill out the POMIS application form.

- Submit identity proof, address proof, and passport-size photographs.

- Deposit the amount via cash, cheque, or demand draft.

- It is advisable to appoint a nominee to ensure smooth fund transfer in case of any unforeseen circumstances.

Monthly interest is credited directly into your post office savings account.

⚠️ Premature Closure Rules

While the scheme is meant for 5 years, you can close it early, but with penalties:

- Before 1 year: Not allowed

- Between 1–3 years: 2% deduction from principal

- Between 3–5 years: 1% deduction from principal

This ensures that only those who want a long-term regular income stay invested.

💡 Tax Rules

- The interest income from this scheme is subject to taxation according to the investor’s applicable income tax slab.

- No TDS (Tax Deducted at Source) is applied, but you must declare it in your income tax returns.

- No benefit under Section 80C is available for investment in POMIS.

🟢 Key Benefits of POMIS

- Safe and government-backed

- Fixed monthly income

- No market risk

- No TDS on interest

- Simple account opening process

- Option for joint and minor accounts

⚖️ POMIS vs Other Government Schemes

| Scheme | Interest Rate | Payout Frequency | Who Can Invest |

| POMIS | 7.40% p.a. | Monthly | Any resident Indian |

| Senior Citizens Savings Scheme (SCSS) | 8.20% p.a. | Quarterly | Retirees above 60 or 50+ (on VRS) |

| RBI Floating Rate Bonds | 8.05% p.a. | Half-Yearly | Any resident Indian |

Note: SCSS offers the highest interest, but has an age restriction and pays every 3 months. RBI bonds have a 7-year lock-in and pay interest twice a year. POMIS offers a balance between safety, frequency, and accessibility.

👨👩👧👦 Who Should Invest?

POMIS is ideal for:

- Retirees looking for fixed income

- Homemakers needing passive income

- Parents planning for children’s future expenses

- Conservative investors who prefer zero risk

📌 Things to Remember

- Open a Post Office Savings Account before applying

- Monthly income is fixed, even if interest rates change later

- Renewal is allowed once after maturity, but no additional deposit can be made

- POMIS is not linked to inflation, so returns are steady, not increasing

✅ Conclusion

The Post Office Monthly Income Scheme (POMIS), introduced by India Post, is a safe investment avenue that guarantees a stable monthly payout. It’s best suited for people who want peace of mind, without worrying about market risks. While it may not offer the highest returns, the certainty and simplicity it offers make it one of the best monthly income options in India today.

If you want to secure your future, POMIS deserves a serious look.

ALSO READ I 10 MUST-KNOW BENEFITS AND UPDATES FROM THE DIRECTORATE OF CANTEEN SERVICES IN 2025

[…] ✍️ Also read: For Post Office Monthly Income Scheme (POMIS) details and retirement monthly income planning, read t… […]